Bussiness

XRP at a standstill? What the price indicators suggest

- XRP’s price trades close to its key moving averages.

- This suggests that the market is in consolidation.

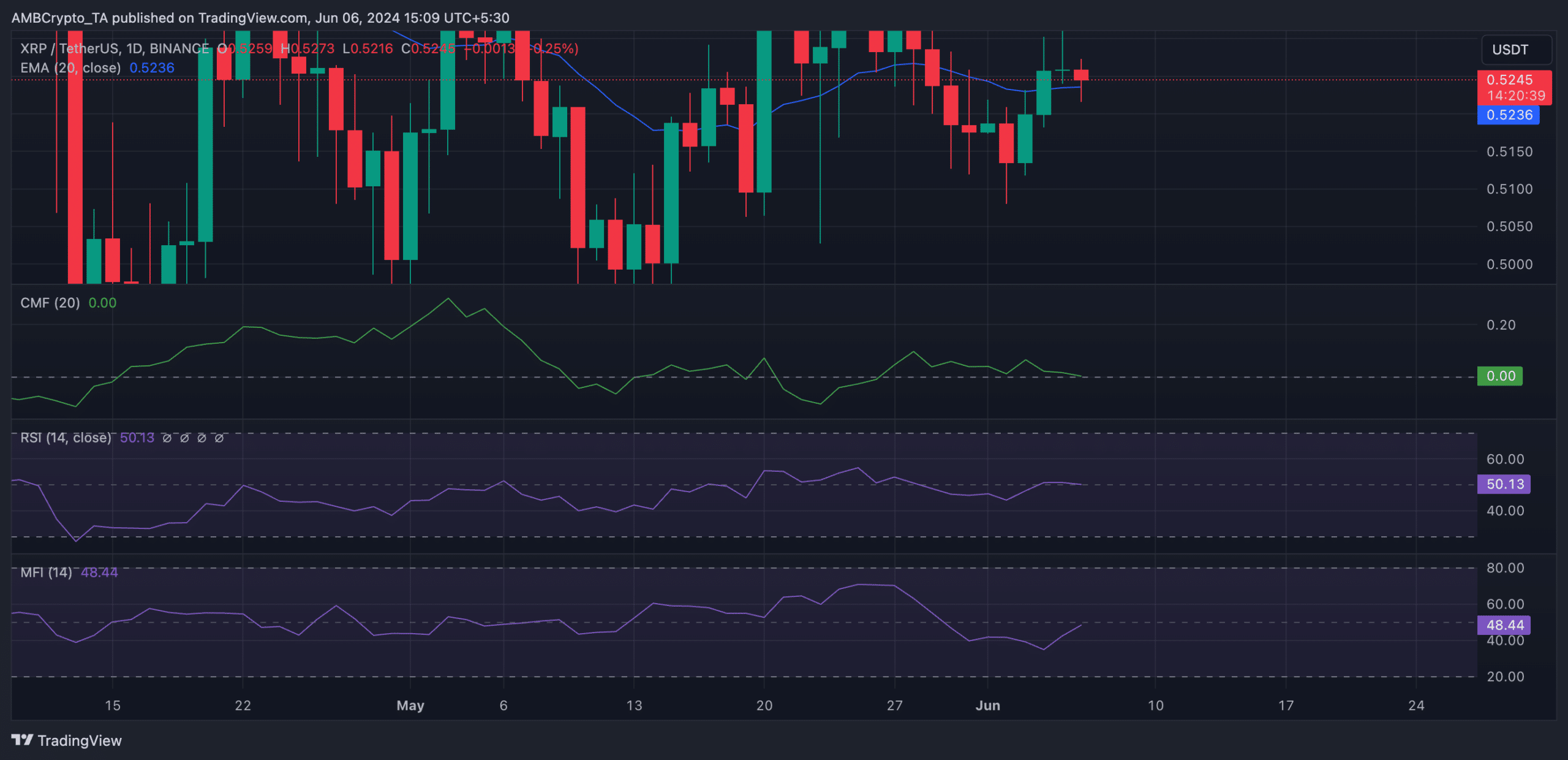

Ripple [XRP] has traded close to its 20-day exponential moving average (EMA) in the past few days, indicating uncertainty about the token’s next price direction.

When an asset’s price trades close to this key moving average, it suggests that the market is in consolidation. It signals a relative balance between buying and selling; neither the buyers nor sellers have a distinct advantage.

The bears and bulls are at equilibrium

At press time, the altcoin exchanged hands at $0.52, according to CoinMarketCap data. Confirming the lack of a trend in either direction, XRP’s key momentum indicators were close to their respective center lines at press time.

For example, its Relative Strength Index (RSI) was 50.13, while its Money Flow Index was 44.44. At these values, the indicators suggest that the XRP market was in consolidation, as the altcoin was neither overbought nor oversold.

However, XRP’s Chaikin Money Flow (CMF) rested on the zero line at press time and was in a downtrend. This signaled liquidity exit from the altcoin market.

The CMF indicator measures money flow into and out of an asset. When its value is zero or less than zero, it suggests capital exit from the market. It is a bearish signal and often a precursor to a decline in an asset’s value.

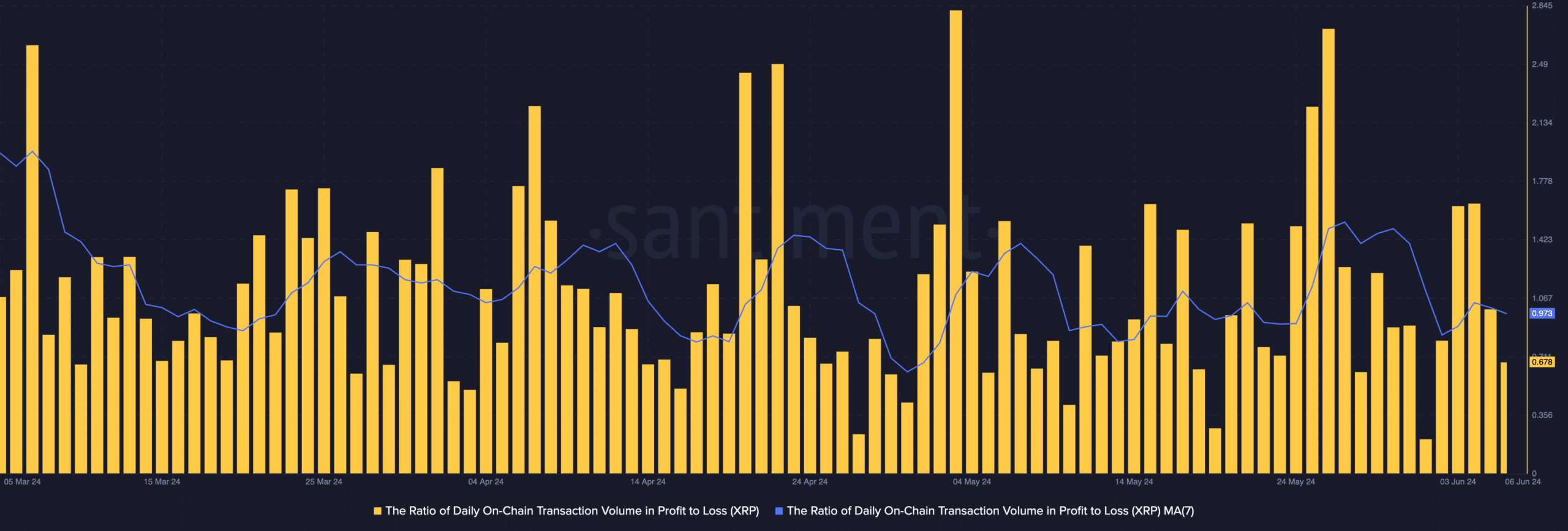

The reason for liquidity exit from the XRP market is not far-fetched. In the last week, most of the transactions involving the token have ended in losses.

AMBCrypto assessed the daily ratio of XRP transaction volume in profit to loss (using a seven-day moving average) and found that its value was 0.97.

This meant that for every XRP transaction that returned a loss in the past seven days, only 0.97 ended in profit.

Futures traders are looking to initiate a rally

Open interest in XRP’s futures market has surged since the beginning of the month. At $661 million at press time, it has since increased by 7%, according to Coinglass.

The token’s futures open interest measures the total number of outstanding futures contracts or positions that have not been closed or settled.

Read Ripple’s [XRP] Price Prediction 2024-25

When it grows, it means more traders are entering the market and opening new positions.

XRP’s positive funding rate confirmed that these new traders predominantly open long positions. This means most XRP futures traders are buying the coin in the expectation that its price will grow.

)