Bussiness

Will XRP fall to $0.28 before the next bull run starts?

- XRP showed resilience with a slight recovery, yet faced a potential drop to $0.28.

- Long-term analysis suggested a bullish outlook, with prices potentially soaring by 2025-2026.

XRP has recently exhibited minor signs of recovery in a market still dominated by bearish trends, briefly ascending to a 24-hour high of $0.48 after a decline to $0.46 yesterday.

At the time of writing, XRP’s price stood at $0.4738, marking a modest increase of 0.3% over the past day. This slight uptick comes amid general market downturns, hinting at XRP’s resilience in a volatile environment.

Despite this small rebound, the broader scenario for XRP traders remains challenging, with significant liquidations continuing to affect the market.

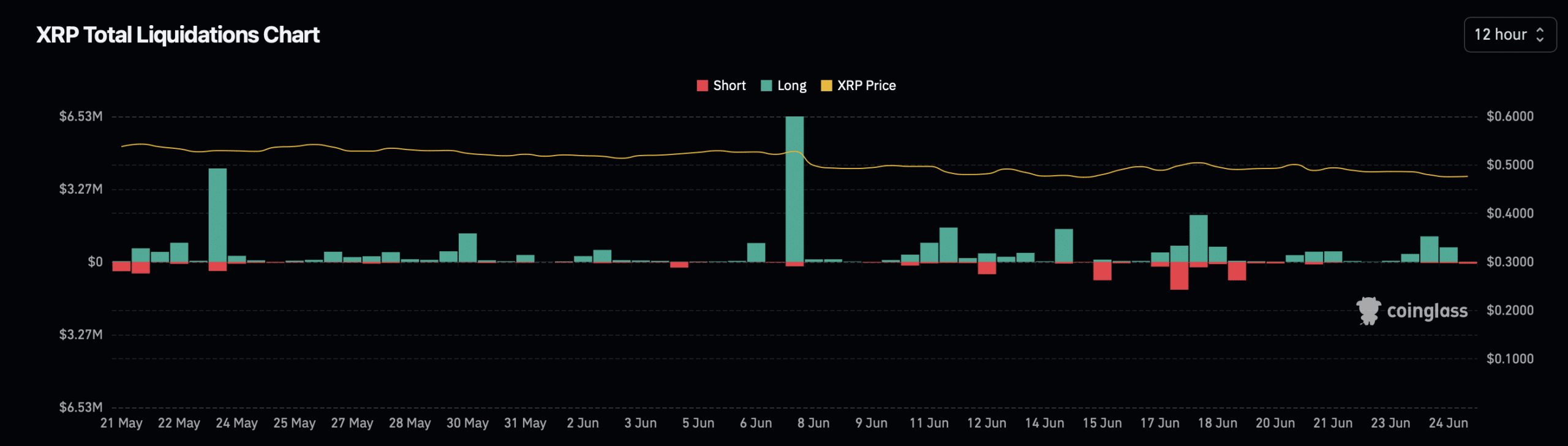

According to AMBCrypto’s analysis via Coinglass, the past 24 hours have seen 67,075 traders liquidated, with a total value of approximately $303.88 million.

Of this, XRP-related liquidations accounted for $1.25 million, predominantly impacting long position holders.

Will XRP plunge below $0.3?

According to analyst Cheeky Crypto, the XRP/USDT trading pair suggested a continued bearish outlook in the short to medium term.

The price movement within a parallel downward channel and its position below key exponential moving averages (EMAs)—50 EMA at 51.6, 50 SMA at 51.1, and 200 EMA at 54.4—reinforced this trend.

These indicators, coupled with a potential head-and-shoulders pattern, suggested further declines, possibly reaching lows between $0.28 and $0.33.

However, there’s a silver lining as overlapping candlestick patterns indicate imminent volatility, which could disrupt the bearish momentum.

While the short-term outlook might seem grim, the longer-term perspective based on Elliott Wave theory and stochastic RSI points to an oversold condition on weekly and monthly charts.

This suggested that XRP could eventually rebound significantly, with projections showing potential highs between $5.59 and $126 in the next bullish cycle around 2025 or 2026.

Assessing market sentiment

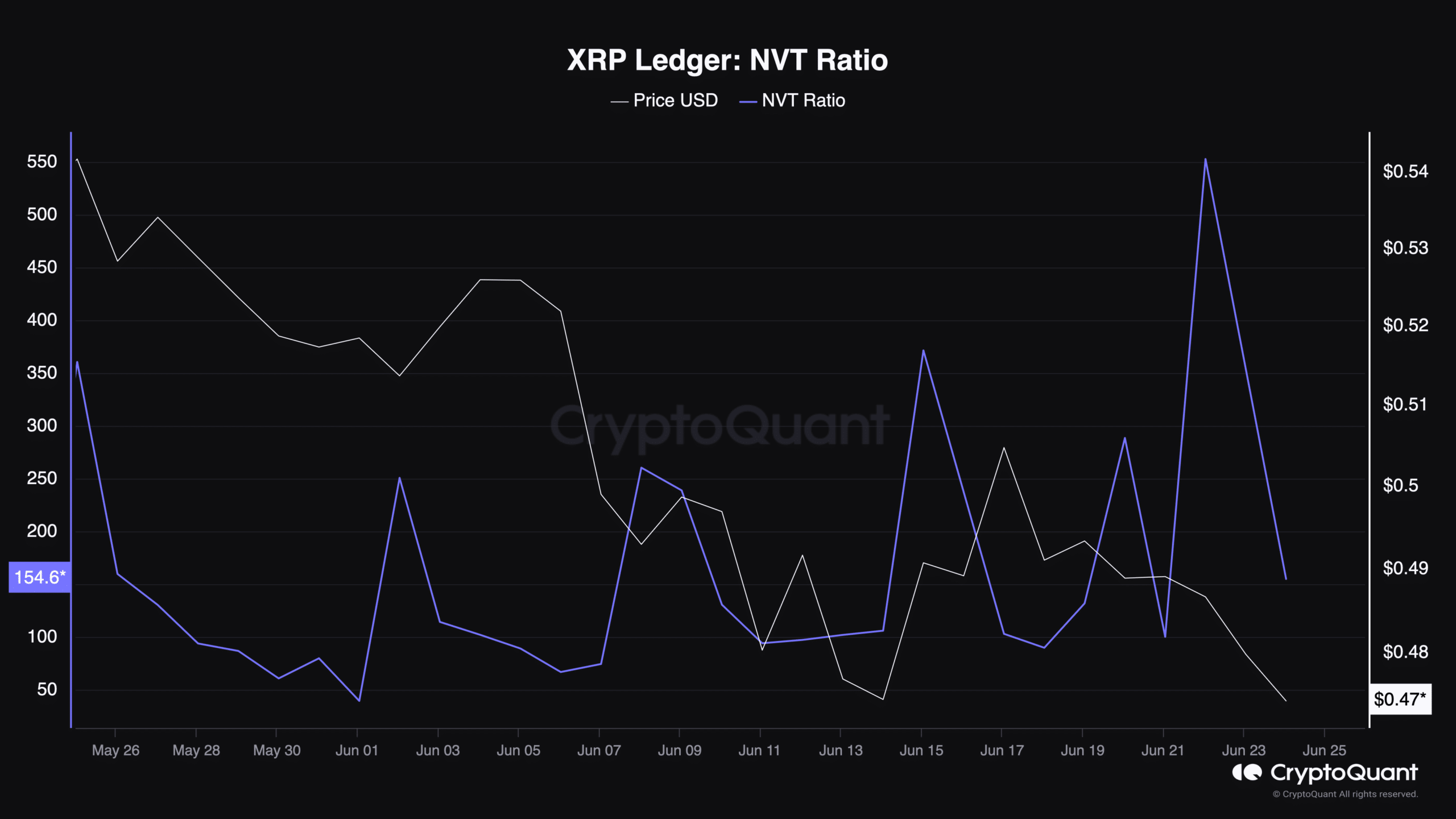

Further insights into XRP’s market sentiment can be gleaned from its Network Value to Transactions (NVT) ratio, which was 154.6 at press time.

The NVT ratio, which compares the network value (market cap) to the daily dollar volume transmitted through the blockchain, indicates how high the current valuation is in relation to the actual amount of transactions.

A higher NVT ratio suggests that the currency is overvalued relative to its actual transaction volume, which could be a bearish signal for XRP.

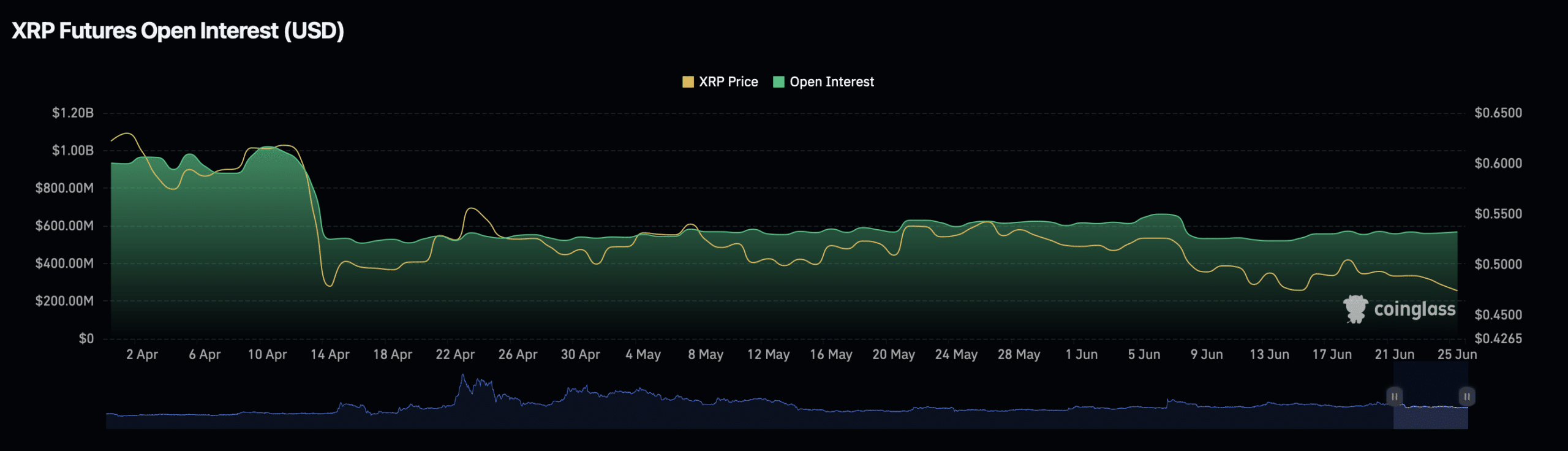

Moreover, data from Coinglass showed a slight uptick in open interest for XRP, with an increase of nearly 1% over the past day, bringing the valuation to $570.77 million.

Is your portfolio green? Check out the XRP Profit Calculator

Additionally, there has been a 50% surge in open interest volume, now valued at $1.11 billion. This increase coincided with reports from AMBCrypto, which suggested emerging bullish signs for XRP.

So, there was a complex, multi-faceted market outlook that combined bearish technical signals with potential bullish sentiment building in the background.

)