Bussiness

Why Justin Sun’s offer to ‘buy all Bitcoin’ will not help BTC at all, right now

- A supply overhang from Mt. Gox and government entities worsened the market sentiment.

- Tron’s founder offered to buy the German government’s BTC holdings to reduce negative market impact.

The crypto market rout worsened on the 4th of July, amidst preparations and test transactions by Mt. Gox to start the distribution of about $8 billion of Bitcoin [BTC].

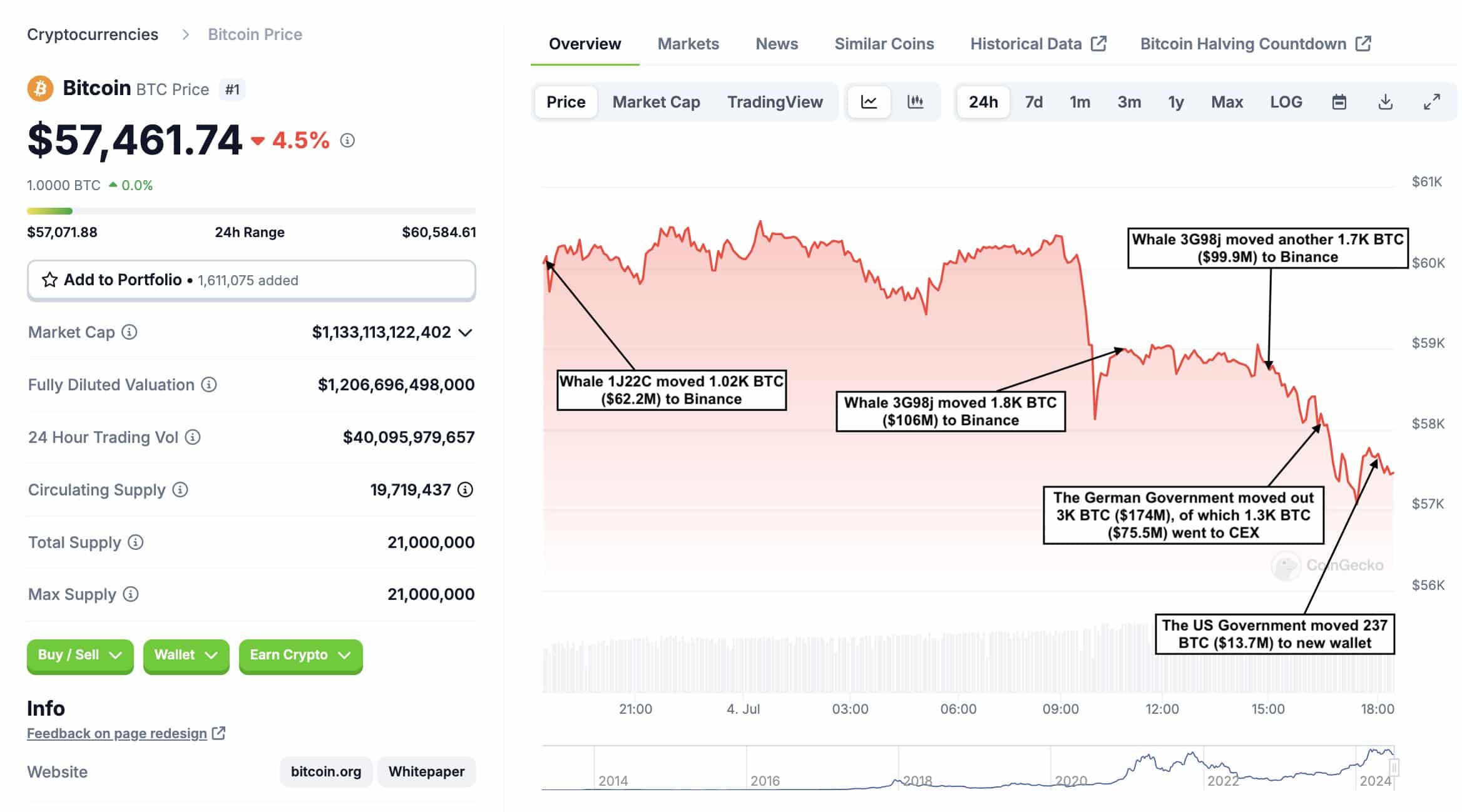

Despite the looming overhang from Mt Gox, the German government continued to sell off its BTC holdings.

On the 4th of July, it moved 3K BTC but dumped 1.3K BTC, worth over $78 million, to Bitstamp, Coinbase, and Kraken, further unsettling the market.

Amidst the ensuing market bloodbath, Tron’s [TRON] founder, Justin Sun, offered to buy all German government BTC off the market to taper off the impact.

‘I am willing to negotiate with the German government to purchase all BTC off-market in order to minimize the impact on the market.’

German Bitcoin holdings and market reactions

According to data from Arkham Intelligence, the German government still had 40.3K BTC, worth $2.3 billion, to offload. However, it wasn’t clear whether Sun’s proposal was legit or just a typical prank.

Nevertheless, perhaps Sun’s offer, even if honored, could not effectively taper off the ongoing market rout. Apart from the German government, three other BTC whales also dumped on the 4th of July and dragged BTC to $57K.

Spot On Chain data revealed that the U.S. government also moved $13.67M of BTC and still held $12.3 billion.

Additionally, two unmarked whale wallets offloaded over 4.5K BTC, worth nearly $270 million, further compounding the selling pressure.

For his part, crypto market commentator Samson Mow criticized the German and U.S. governments’ decision to sell BTC directly to exchanges.

‘Imagine selling the hardest form of money that has ever existed…Finally, imagine selling on exchanges with market orders, driving the price lower so you get even less.’

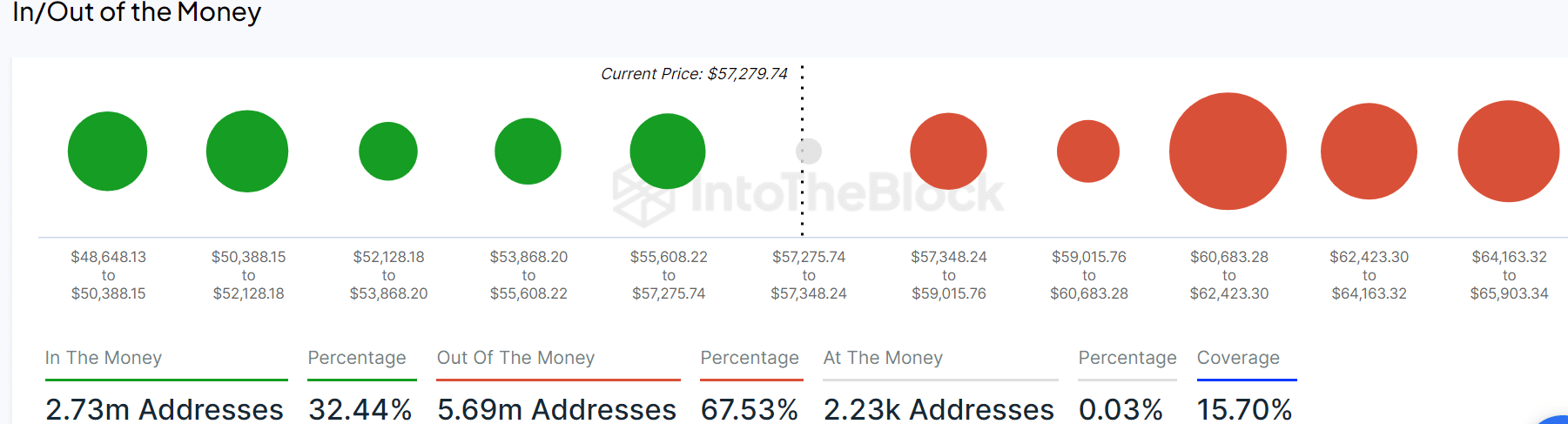

The drop to the $57K level resulted in a loss for over 65% of BTC addresses, especially for users who bought between $48.6K and $65.9K.

Additionally, the extended dump liquidated $113 million BTC positions, with longs bearing the brunt of nearly $100 million rekt positions in the past 24 hours.

)