Bussiness

USDC gains ground: Tether’s market share drops to 74% in 2024

- Tether USDT market share drops from 82% to 74%

- Regulated stablecoins such as USDC gains market share depicting changing market preferences.

With increased crypto adoption and widespread use globally, stablecoins have emerged as favorites among investors and as a store of value for many crypto users.

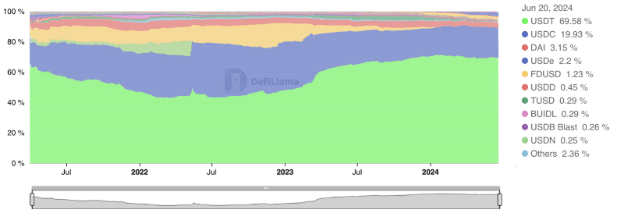

Over the recent years, Tether has been the dominant crypto in a highly concentrated stablecoin market. Despite the dominance, the market sentiment is shifting, and Tether’s dominance is slowly fading.

As of this writing, Tether’s USDT trading volume has declined by 8.8% in 24 hours to $38.65 billion.

Tether USDT market share declines

According to Kaiko’s report, Tether’s market share is continually declining. It was also found that USDT’s market share on Centralized Exchanges dropped from 82% to 74% in 2024.

The decline arises from an increased shift in market sentiments and regulation on stablecoins. Over the past year, other stablecoins, such as FDUSD, have captured the market, especially since the partnership with Binance.

These factors have pushed Tether’s market dominance to a test.

Increased competition

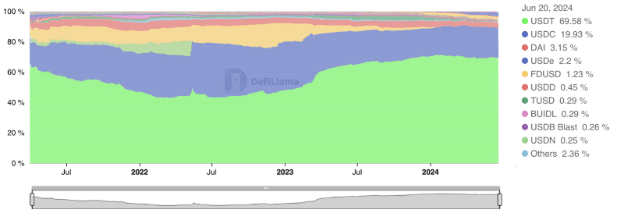

As reported by AMBCrypto, USDC trading volume surged to $23 billion in 2024 from a low of $9 billion in 2023. The rise in USDC arises from the increased demand for compliant stablecoins.

Major investors, especially institutional ones, are slowly shifting to legally accepted stablecoins to ensure they comply with operational requirements, especially in the European Union.

As reported by Kaiko, USDC’s market share has increased to 12%, nearing FDUSD at 14%.

With higher trade in major crypto exchange platforms such as OKX, Binance, and Bybit, USDC has become a serious competitor to Tether. Furthermore, MICA approval of CIRCLE has significantly boosted USDC’s market share and trading volume.

Also, as keyrocktrading shared on X, USDC is outpacing Tether regarding flexibility and accessibility. He noted that,

“USDC’s supply is more elastic than Tethers’. It offers zero fee minting and is more accessible, as dealing with Tethers involves Long transfer times to smaller banks in the Virgin Islands.”

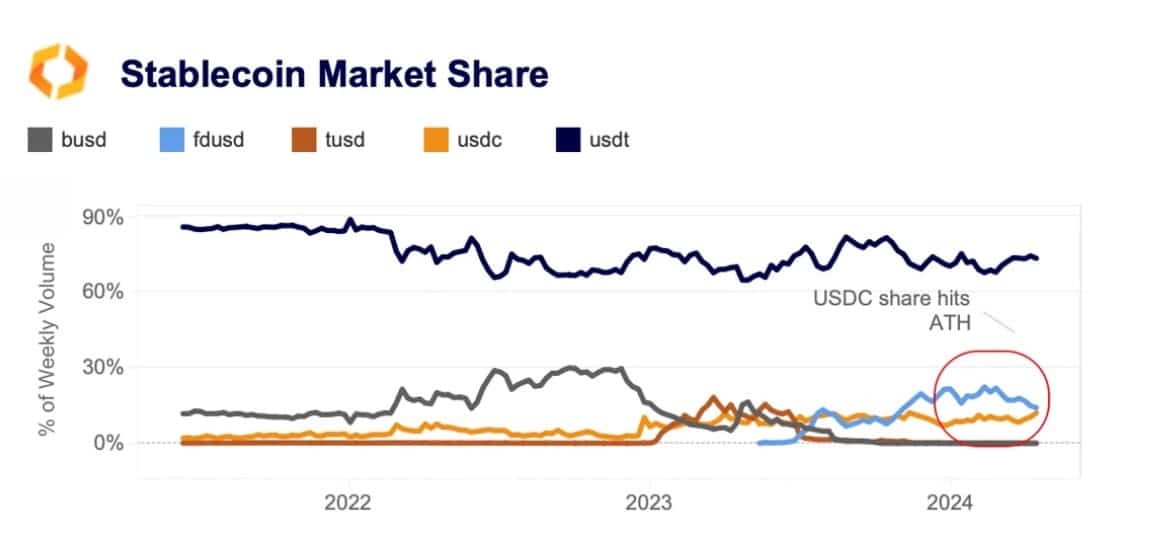

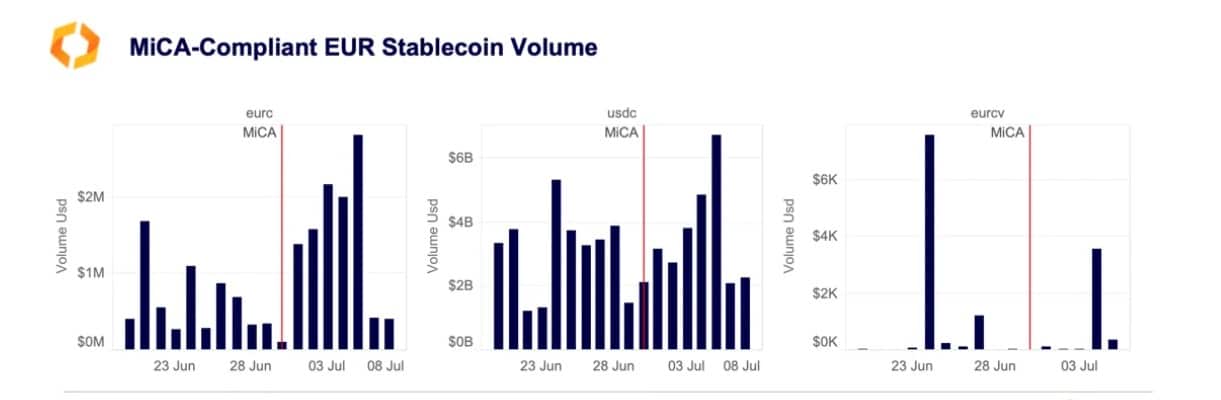

EU regulation of Stablecoins

Notably, Europe Markets in Crypto Assets Regulation (MICA) is set to challenge the continued dominance of non-compliant stablecoins.

With MICA’s requirements into effect, exchange platforms such as Kraken might be pushed to reconsider their position on stablecoins like Tether. These regulations have concerned major players about their EU operations, even for approved stablecoins.

For instance, Tether CEO argued these requirements might result in complications among stablecoin issuers.

Broadly, MICA has set a precedent that will challenge the existing crypto operations in the European Union.

Tether awaits suspension of USDT redemptions

According to official reports. Tether is expected to suspend USDT redemptions across major blockchains by September 2025.

Source: X

Francesco noted this development on X (formerly Twitter), sharing that,

“Tether has announced that it will stop minting USDT on EOS and Algorand as of today. However, USDT redemptions on these blockchains will continue for the next 12 months.”

This comes after the 2023 suspension of Tether USDT on other blockchains such as Bitcoin, Kusama, and Bitcoin Cash. For the next 12 months, Tether will suspend operations within multiple aiming to utilize effective networks for better user experience and general stability for the stablecoin.

)