Jobs

Treasuries Gain as Mounting Data Point to Softer Inflation, Jobs

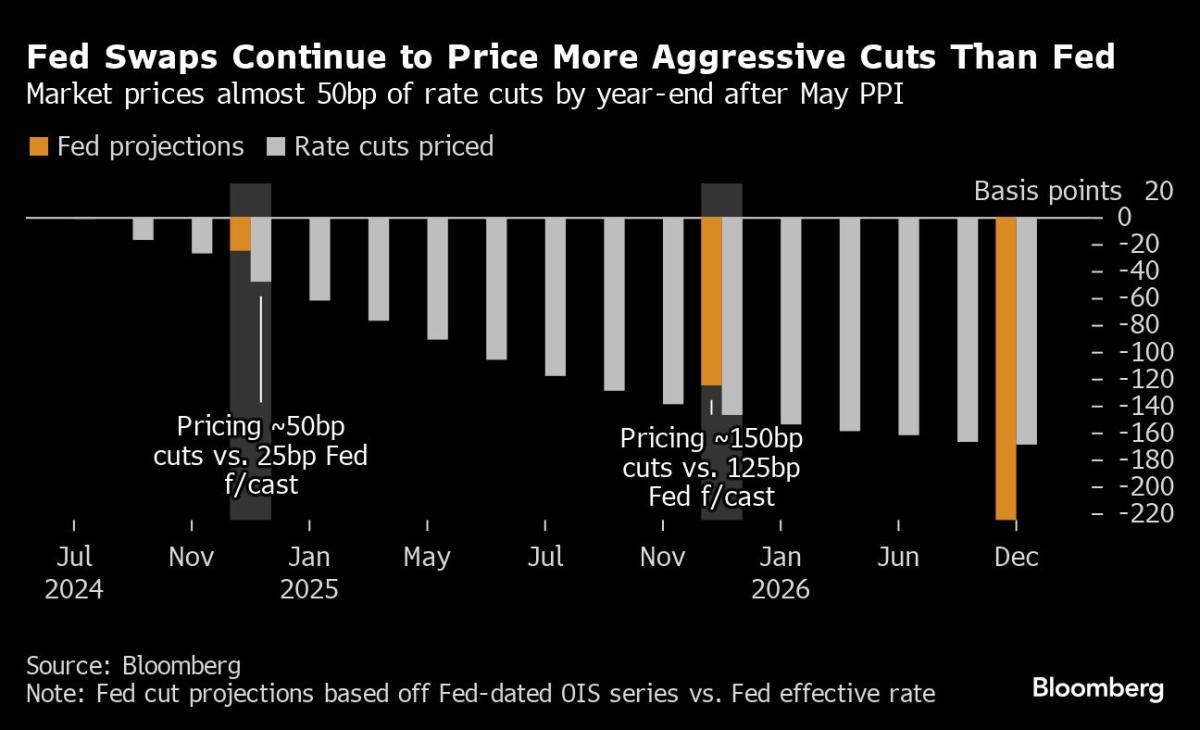

(Bloomberg) — Treasuries rallied, sending most yields to the lowest levels since early April, as data on wholesale prices and jobless claims supported wagers the Federal Reserve will wind up cutting interest rates more than policymakers anticipate.

Most Read from Bloomberg

Yields across the maturity spectrum declined on Thursday, with shorter maturities that are more sensitive to Fed interest-rate changes remaining lower by as much as five basis points. The two-year note’s yield fell as much as 9 basis points to 4.66%. Long-maturity yields declined less, hampered in part by anticipation of an auction of 30-year Treasury bonds later in the session.

Market-implied expectations for Fed rate cuts beginning as soon as September increased, deepening a rift between investors and the central bank, which this week projected a more-conservative course.

Separate reports showed the rate of increase of wholesale prices unexpectedly slowed in May, while new jobless claims jumped to the highest level of the year. Fed policymakers, who on Wednesday projected they’d cut rates by a single quarter-point increment this year, less than their previous quarterly forecast, are awaiting indications of lower inflation, labor market weakness — or both — before they act.

The wholesale price data follow a report on consumer price trends released before Wednesday’s Fed meeting that also showed unexpected deceleration.

“You’re definitely seeing more signs of disinflation and a softening labor market with the data this morning,” said Zachary Griffiths, head of US investment grade and macro strategy at CreditSights. “This, combined with yesterday’s CPI print, certainly strengthens the case for the Fed to move sooner rather than later.”

Inflation expectations implied by the yields on inflation-indexed bonds declined further. For five-year Treasury inflation-protected securities, the average consumer price inflation rate needed to break even with higher-yielding regular Treasuries dropped to about 2.17%, the lowest since January.

“The inflation bump of the first quarter is fading out,” said Ed Al-Hussainy, rates strategist at Columbia Threadneedle Investments. “You can see breakeven markets sniffing this out.”

Fed policymakers also revised up their expectations for inflation in the projections released this week, however. For the PCE price index, which they’re aiming to bring down to a 2% rate from 2.7% in April, they projected a year-end rate of 2.6%.

Thursday’s gains lowered the anticipated yield investors will receive in the latest monthly auction of 30-year Treasury debt at 1 p.m. New York time. Demand metrics for the auction will reveal the limits of what they are willing to accept.

The $22 billion auction is a reopening of last month’s $25 billion new issue, meaning the bonds being sold pay the same fixed rate and mature on the same date as the existing ones, making them identical. Their yield in pre-auction trading was about 4.45%, down from a peak of about 4.60% on Monday.

–With assistance from Michael Mackenzie.

(Adds inflation expectations and auction information beginning in seventh paragraph. Updates yield levels.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

)