Travel

The Heinemann view – Diversification, collaboration and investment in travel retail’s future

In this report, which first appeared in our May Magazine (click here and go to page 98 of the digital edition) we feature key takeaways and talking points from the annual Gebr. Heinemann press conference.

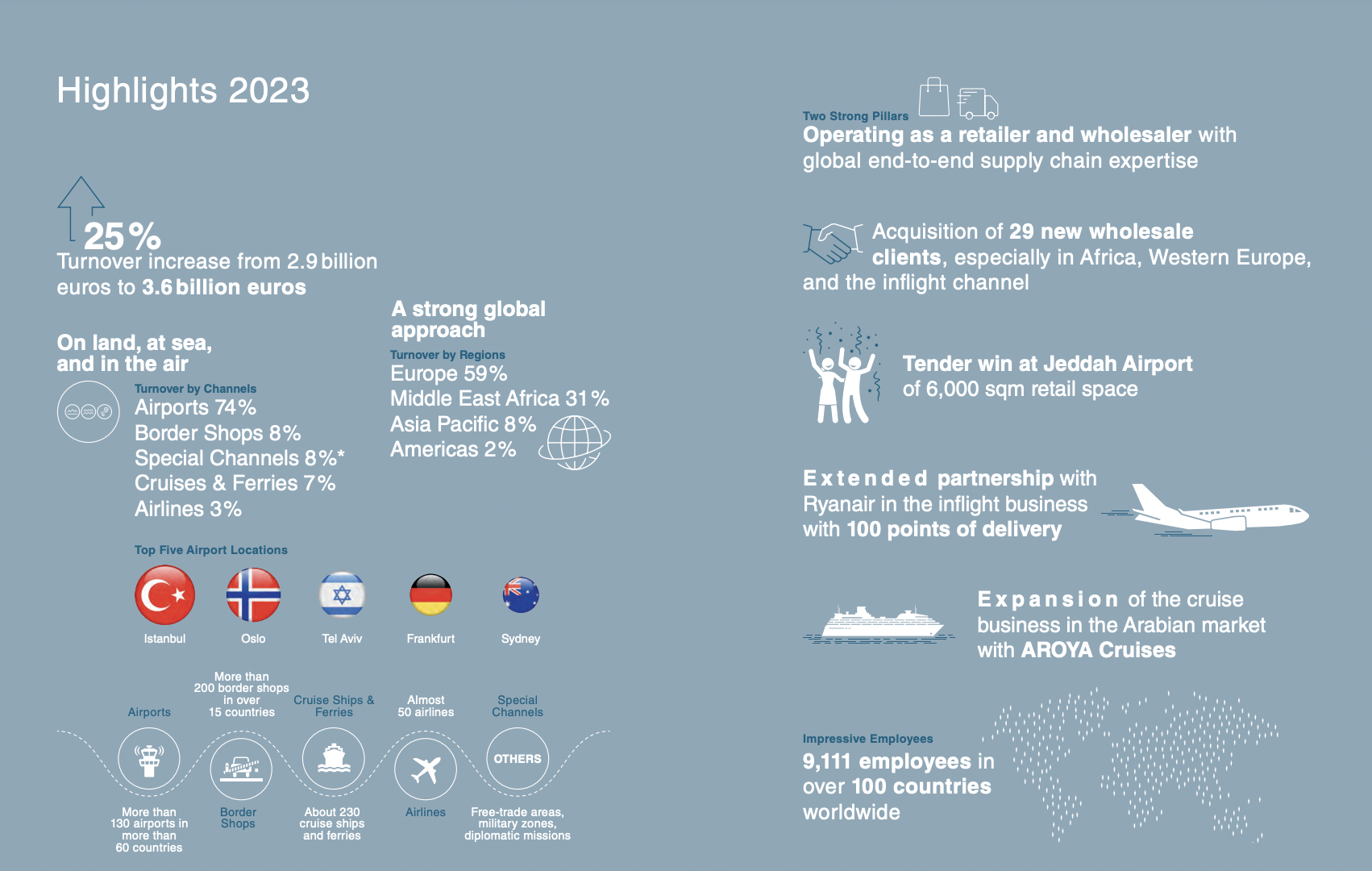

Leading travel retailer and distributor Gebr. Heinemann last month revealed details of its performance in 2023, as it returned to 2019 levels of turnover at €3.6 billion, up by +25% year-on-year.

The results were announced at the annual Gebr. Heinemann press conference in Hamburg, led by Co-CEOs Max Heinemann and Raoul Spanger and Chief Commercial Officer Inken Callsen.

Retail turnover in 2023 grew by +24% to €2,291 million while distribution rose +27% to €1,175 million.

With sales of €2,565 million, the airport business remained the largest channel, with a 74% share, up +25% year-on-year. The border shop business contributed 8% of sales at €280 million (+9% year-on-year), followed by cruises and ferries at €239 million (7% of the business, +21%) and airlines with a flat turnover year-on-year of €102 million (3% share).

In addition, other channels such as the diplomatic business, free trade zones, military bases and beauty investment Nobilis Group generated a combined turnover of €277 million.

With +24% sales growth in Q1 2024, Gebr. Heinemann says it is ahead of budget to date this year on track to exceed €4 billion in annual turnover for the first time.

At the same event last year, post-pandemic resilience, management of risk and Heinemann’s contractual ‘red lines’ were among the big talking points.

This year the company’s senior management focused on business diversification – already a key topic – Heinemann’s status today as a group of companies, key sustainability goals, category trends and creating change and adding value to the industry. We present the key talking points.

Talking point I – An increasingly diversified group

Gebr. Heinemann reinforced key messages about its diversification strategy at the media day, highlighting its purchase of the remaining 50% of JR Duty Free in Israel from the Danos family, the move to acquire border shop business Travel Free Czech in full (adding to its existing 50% stake) and its 2023 acquisition of a 50% stake in Nobilis Group, a leading distributor in the luxury/niche, prestige and lifestyle fragrances segment across the German-speaking region in Europe.

Co-CEO Raoul Spanger said: “These are the biggest investments we have ever made in other companies and they show the financial strength of Heinemann. They also show the commitment of the family to the company and the commitment of the company to the market. Consolidating these will have a big impact on 2024 results.”

Co-CEO Max Heinemann said: “We are very proud that we have been able to grow as a global group of companies: by entering into carefully selected new partnerships, expanding existing partnerships and making strategic investments in other business segments and channels to push the collaborative envelope of our entire industry and beyond.”

On diversification outside travel retail, with the Nobilis deal, Heinemann said: “We as an industry experienced a time when our industry was not relevant so we looked at opportunities that remained relevant through COVID-19.

“Culturally Nobilis is a great fit. We are not integrating it into Heineman operations but it is something that we understand. We are very happy about this and it’s something you might see more from us as we diversify more after COVID.”

Asked about further diversification, for example into channels such as food & beverage, Heinemann said: “F&B is a topic for us though we don’t have a particular acquisition or partnership to announce. We see F&B’s role in marketplaces, such as we have created with casualfood for the Smartseller concept at small to medium-sized airports.”

The company also widened its presence in both retail and distribution channels, the latter with 29 new customers, mainly in Africa, Western Europe and in the inflight channel. “Distribution offers a strong second leg of the business and means we are even more diversified,” said Spanger.

In retail, the company is set to enter new territory at Jeddah Airport with joint-venture partners Jordanian Duty Free Shops and the ASTRA Group and now also manages stores aboard AROYA, the first ship of Cruise Saudi’s newly-established cruise company.

This builds on other gains last year that included the extension of the Heinemann business at Copenhagen Airport for a further ten years alongside a return to Düsseldorf Airport.

Talking point II – Category performance and collaboration

By category in 2023, 47% of turnover came from liquor, tobacco and confectionery (LTC), slightly down on the 2022 figure of 50%, followed by the beauty category with 41% (37% in 2022) and fashion, accessories, watches and jewellery (FAWJ) with 7% of turnover (same as in 2022).

Chief Commercial Officer Inken Callsen identified some of the key performers in the year.

In liquor, which is 33% of the LTC business and grew 12% year-on-year, the fastest growth segment was tequila.

In wine & Champagne, among the key developments this year will be the opening of a Cave de Champagnes concept at Istanbul Airport with Moët & Chandon, which will integrate other brands for wider appeal. In this category digital tools such as Lift & Learn and ratings tool Vivino have helped education and engagement.

Callsen highlighted the power of exclusives and promotions, including the current rock ‘n’ roll-themed animation with Rod Stewart-owned Wolfie’s Whisky at Hamburg Airport.

She noted that the business had witnessed some tapering off at the luxury end in spirits into 2024. “People are ready to spend but somehow they are spending less on [prestige] whiskies; we have seen a trend towards lower prices. Premiumisation is still important but it’s about having a differentiated offer, it’s not about raising prices on mid-level items which is one thing that has happened.”

Tobacco is a still significant 30% of LTC turnover (turnover grew +9% year-on-year) and remains a key penetration driver. Callsen said: “We see more Next Generation Products entering the market which should keep this segment going over the decade ahead, even if traditional tobacco is under pressure.”

Confectionery retains a 25% share of LTC sales, and grew +23% last year; this category will be driven by exclusives and sustainable products in future, said Gebr. Heinemann.

Within P&C, fragrances dominate share with 71% of turnover in 2023, of which 10% is niche perfumes. At Istanbul Airport, niche perfumes achieved a +42% increase in turnover compared to 2022, and account for 20% of fragrances sales.

While skincare sales surged +30% last year the category is still missing the China influence, said Callsen.

Within the broad FAWJ category, fashion alone took a 22% share and rose by +24% last year, driven largely by expansion at Istanbul Airport, notably at the airside Luxury Square zone.

Accessories represented a 42% share of FAWJ (up +18%) while watches & jewellery (36% of turnover) grew fastest in 2023 at +41%.

Of the opportunities, Callsen said: “We are working on a kids concept to enlarge the accessories offer. Sunglasses are always strong within the accessories business.

“We also launched a pre-owned range onboard Icon of the Seas (including Rolex) and are introducing this in Europe too.”

Of the size of assortments post-pandemic, Callsen said: “We are not back to where we want to be but we are getting there, without simply adding back a lot of brands into the offer. There is a limit on space we can give and we are not doing this in the best way everywhere and there is potential to do better on assortment. It will be one of the big projects we tackle this year.”

The company said that identifying new trends and innovations continues to play a major role within all categories. Heinemann has been carrying out ‘Test & Learn’ pilot projects for new brands that have the opportunity to present their products for a limited time and enter the travel retail market if successful.

Commenting further, Callsen said: “We want to develop the market with the individual strengths of our partners and create added value for travellers. We attach great importance to partnerships and cooperation and want to be successful together. This is what I call the power of collaboration.”

Talking point III – Laying down ambitious ESG goals

In addition to the financial key figures, Gebr. Heinemann also highlighted its key sustainability targets during the annual press conference.

“We have defined ambitious sustainability goals for environmental, social, governance, and responsible value chain action fields and have embedded them in our group strategy. In order to develop and implement this ambitious sustainability strategy, we need to work hand in hand with our customers, partners, and suppliers,” said Co-CEO Raoul Spanger.

For example, on the environment, the company’s goal is to achieve net zero emissions in Scope 1 and 2 by 2030 and achieve a -50% reduction per ton of sales volume in Scope 3 by 2030.

In addition, the company said it is paying close attention to compliance with human rights in its supply chain and aims to cover at least 80% of its purchasing volume through independent supplier assessments by the end of 2024. A newly developed global strategy for diversity, equity, and inclusion as part of the social action field should be confirmed by ISO certification in 2025.

Elaborating on Heinemann’s ESG targets, Spanger said: “We have 18 Diversity, Equity and Inclusion goals, and this is also our challenge. When we say we are a human-centric company, carrying this across global teams and cultures is not easy. We have to listen to our branches around the world and not rule from the headquarters as we don’t have all the answers. We rely on our group of companies across markets and cultures.”

These ambitious targets will play into action taken across the Gebr. Heinemann group. For example, in the beauty category, Heinemann has entered a forward-looking sustainability partnership with L’Oréal, which was announced at the 2023 TFWA World Exhibition in Cannes.

The partnership is based on a joint business plan that defines actions in the areas of assortment, point of sale, supply and social engagement. Both companies will also develop sustainable point-of-sale materials and work together to make the supply chain more sustainable. Gebr. Heinemann said is already working on entering sustainability collaborations with partners in other categories.

Of the sustainability targets, Spanger said: “This drives a lot of what we do. By taking these initiatives we want to show we are an industry leader and we even aim to go beyond our targets. It’s the most important change we are making, even if it’s not seen from the outside.”

On the theme of sustainability, Max Heinemann noted that airlines, airports and travel retail players needed to lean much more on each other. “This topic is part of today’s tender evaluations but it must go much further. It’s important that the airport asks us for our plan to have positive impact. But when we are asked about this we also need to be able to say, where are you on that journey and how can you help us deliver on our sustainability promises?

“These topics also feed into how the business model is shaped or changed, and we will be more vocal on this, as we have been in the past year or two.”

Talking point IV – Empowering people

Gebr. Heinemann highlighted its ‘People & Culture’ approach that aims to strengthen the cooperation and cohesion of the group. This takes into consideration its global and cultural influences while, at the same time, valuing ‘human-centricity’, a core value.

Ché Lewer joined the Hamburg headquarters in September 2023 to head up the division formerly known as Human Resources (HR). Over the past seven and a half years, she has assumed various senior HR leadership positions at Heinemann Asia Pacific and Heinemann Australia.

Co-CEO Max Heinemann underscored the importance of her People & Culture leadership role, saying: “Ché’s ultimate strategy – she is a true global citizen – and to connect us much more than ever. We are a group of companies where all can learn from each other.”

He added: “We have grown over 145 years into a global, diverse, complex, multicultural organisation. The HQ is for us the platform to collect best practices from around the world, putting them on the table and seeing how we can all benefit from them. Increasing group collaboration is important for us and we communicate internally on this a lot.

“We need to leverage the great skills of our people while helping them to drive their own careers. So this we want to globalise with a global career pool where we are working on concepts, driving exchange programmes in the future as well, so that our teams can learn from one another and bring their own story and expertise to bear.”

Heinemann added: “We know that trends are not happening in the same way right across the world so we have to empower our local teams to understand and lead the strategy using their expertise.”

Talking point V – Co-creating change with the industry

Gebr. Heinemann has invested for several years in industry change via vision hub GHARAGE – and, according to Co-CEO Max Heinemann, will continue to “foster innovation and challenge the status quo”.

At the April media day he said: “We need to engage travellers even more and unlock the potential by thinking industry-wide and not only about our own companies.”

He highlighted how Avolta last year joined Heinemann (via GHARAGE Ventures) as an investor in the Duffle start-up whose mission is to digitise the travel retail and F&B sector and travel service offerings at airports globally.

Of this development, Max Heinemann said: “This type of partnership or co-investment was not something that happened in the past. It is not something we try to own but it puts the customer at the centre of what we do and we all get to know each other better in this way without direct competition. It’s not the last initiative we will invest in that will influence the future path of the industry.”

Talking point VI – The future of supply chain

While supply chain challenges post-pandemic have eased, with product availability back close to normal levels, Gebr. Heinemann noted that disruptions reverberate over the long term and many cannot be solved quickly.

Chief Commercial Officer Inken Callsen said: “We have turned all of this into opportunities and will focus on a transformation of our supply chain backbone into a sustainable, resilient, and the industry’s top-performing supply chain.”

She said this would be built on four key pillars: Performance, scalability, cost efficiency and sustainability.

A first step last year was to open the ‘N-Hub’ in Oslo so that all Norway products are supplied from a local base.

In a related development, Heinemann aims to grow closer to its regional markets by creating a new logistics hub with a third-party provider in the Middle East. This will complement the operations of German distribution centres in Allermoehe and Erlensee.

To sustainably build supply chain, last year Heinemann hosted a Sustainability Summit, to which it invited its forwarding agents, sharing its key sustainability targets. One development in this regard was the very first supply shipment to Istanbul via train from Germany in late April.

Heinemann said it remains highly focused on strengthening its supply chain, the “backbone of our business model”, to improve efficiency and boost sales performance further.

On data-sharing, Heinemann highlighted its HeiSights data platform that offers over 200 suppliers (to date) information on their own product performance, by shop, with customer insights – now expanded to include promotional information and stock availability in-store.

Inken Callsen also called out the work of the Travel Retail Data Innovation Group TRDIG, whose objectives since it launched in 2018 have been to accelerate the global exchange of master data in the channel. “This is very much alive and we’re pleased to see the power of collaboration on this initiative, driven by beauty in particular,” she said.

Talking point VII – Targeting twin-track growth in Middle East and Africa

Building on an already strong position in retail while extending distribution reach is a core focus for Gebr. Heinemann in the Middle East & Africa. The regional market is home to the largest single retail business – the €1 billion-plus operation at Istanbul Airport – and to the €500 million turnover operation at Tel Aviv, now fully owned by the Hamburg-based company after it acquired the remaining 50% of JR Duty Free in Israel from the Danos family.

At the media day in Hamburg, Gebr. Heinemann Sales Director Middle East & Africa Bernard Schlafstein took guests through the strategy and priorities for this business.

“Through our great partners Unifree Duty Free and ATU Duty Free, Istanbul Airport is again performing above budget and above last year,” said Schlafstein.

Fashion & accessories represents a large part of the business, with Russians accounting for 40% of spend in this category at Istanbul last year. “Their contribution has dipped a little this year but that has been replaced by more from the Middle East, including Saudis and Kuwaitis, plus Azerbaijanis and others.”

Schlafstein also emphasised that Türkiye is not only about Istanbul. “We have strong operations with our partners at Dalaman, Izmir, Ankara and Bodrum. Dalaman alone is a €50 million turnover business from only five months of seasonal operations a year.”

In Tel Aviv, no changes are planned to management even with Heinemann taking full control. “The team there is flexible and agile and they manage the business in the best way possible.”

“In 2024 sales numbers are almost back to last year even on much lower passenger traffic. Many airlines are coming back now. We expect turnover to be around 15-20% lower than in 2023 overall.”

In Saudi Arabia, a two-phase opening begins at Jeddah Airport in July, with full opening by Q2 2025. As reported, this is a joint venture along with Jordanian Duty Free Ships and Astra Group. There, in a large retail space spanning over 7,000sq m, a premium fashion offer will be complemented by P&C (including a strong niche perfumes assortment), local products and tobacco. The operation will be branded as Jeddah Duty Free though the Heinemann ‘three sails’ logo will also be incorporated.

To service these operations, a four-person Dubai office opened last year, with a wider remit to grow the client base across both distribution and retail.

In Africa, Heinemann generated €66 million of retail business, principally from the Big Five Duty Free operations at Johannesburg, Cape Town and Durban airports, plus €108 million from supply in the region. The total business spans 35 markets, and includes joint ventures in Egypt, Nigeria and South Africa.

Schlafstein said: “We see a lot of potential for growth in distribution clients in Africa. It’s a safer, more profitable model than retail but we want to grow in retail too where appropriate.

“South Africa represents a double-digit growth business and there is much more to do there. Borders are also an opportunity in Africa. Logistics are not easy, but the potential is there.”

Talking point VIII – Taking on the conversion challenge

During the recent media day, Gebr. Heinemann Director Marketing Jens Peter Peuckert and Director Sales Experience & Excellence Sören Borch outlined how the retailer is aiming to be a ‘valuable travel companion’ in its daily business.

A key element is the focus on ‘physical first, digitally influenced’ activity.

Borch said: “Our task is to work on penetration, turning more passengers into customers. A large part of that is driving experience in retail, when people enter our stores. A big project here is to revamp our retail design. We are working with an agency on Frankfurt Airport Terminal 3 for the new stores that begin construction in February 2025.

“We see T3 as the ‘next level’ airport retail experience. The flow through the store will be one element. We are looking at experience zones by department. Experience is about surprise, it’s about the unexpected. Our programmes there will lean on all the senses. Using more light and sound we aim to create a more immersive experience.

“It’s also about simpler things like reworking furniture too. Local sense and regionality are important for us for a long time and that will become even deeper.”

Under a drive to create ‘unforgettable experiences’ the use of technology to lift traveller convenience is vital. Here, self-checkout and mobile payment options are being rolled out where relevant to the customer base, the latter to all German airport outlets by the summer.

Digital investment also extends to a relaunched web shop at Copenhagen Airport and soon an ecommerce offer at Istanbul Airport.

It also means developing digital tools that inspire and engage, including in-store gaming and hologram-style display for its ‘spectacular assortments’.

Borch said: “As we are a brick & mortar retailer these tools are about offering staff more tools to engage directly with the customers. A big topic for us is what we can do on the shop floor to scale the activations, in partnership with brands.

“Interactive games act as an enabler to open a conversation with the traveller who might then become a shopper or to joining the 1.6 million other members of our loyalty programme Heinemann & Me.”

Peuckert addressed the key travel retail challenge of shifting from ‘anonymous reach’ – where the customer usually only becomes known when they enter the store – to ‘addressable audiences’ who the industry can engage and interact with before, during and after their trip.

A recent pilot partnership with Uber in Germany offers an example of this strategy in action. “From the moment you enter your Uber car you are an addressable audience. We offered a -10% off discount in the relevant store and had good results.

“To scale this we think it’s possible to work with platforms like Skyscanner or the airlines, to address people upon booking confirmation, offer a voucher, use these agencies’ third party data and bring them into our universe to make this first party data.”

Peuckert added: “We still need people to tell us when they travel. If they do we’ll give them something in return, a special offer or discount.

“Once marketing kicks in we can offer click & collect and we even have the ecommerce opportunity for home delivery. It’s all based on past behaviour, offering something aligned to your interest and for this we need to keep offering extraordinary products that are relevant to our audiences.”

A good example was a Heinemann & Me member offer on Jack Daniel’s Single Malt, to which Heinemann offered early access to members last year, with 1,000 bottles sold in the first two weeks of promotion. A pre-launch for a Jägermeister 9556 super-premium expression saw 107 bottles sold at €560 each in 24 hours to Heinemann loyalty members.

Crucially, the average Heinemann & Me member spends double what the non-member does.

“If we know when and where to address the relevant audience we can do many more digital-influenced sales while remaining a physical retailer,” said Peuckert. “I can see a share of 20% of sales coming from loyalty in time. For the travel retail industry more widely there is so much more potential.”

Finally, the Heinemann team also outlined ambitions to expand its GateZero concept that targets Gen Z and Millennials. One is planned for the future Frankfurt Airport T3 store, the company said, with others to be announced.

Borch said: “We see demand from airports for concept stores that target younger travellers. We strongly believe in GateZero.

“Airports are also open to discussing new models to help us operate such stores successfully but on different terms as it’s a big investment on marketing and on product sourcing,” adds Borch. “At Copenhagen Airport the City Series works well but that may not be the case everywhere. It’s based a lot around fashion and sneakers – we think there may be an opportunity for wines, for skincare and for other areas to test and trial.”

Peuckert concluded: “It’s our task to be relevant in future. With all of these experiences, we are diversifying the business and working together with brands to ensure there is always something special going on. We want the shop visit to be more planned than it used to be and with data in the background and great brand partnerships we can encourage people to come earlier because there is something worth seeing.” ✈

*This report first appeared in our May Magazine (click here and go to page 98 of the digital edition).

)