Bussiness

Shiba Inu’s 17% uptick means THIS for memecoin’s long-term odds

- Buying pressure on Shiba Inu has risen over the last few days

- Derivatives metrics also flashed bullish signs for the memecoin

Shiba Inu [SHIB], the world’s second-largest memecoin, registered a promising comeback after a sharp fall over the past week. This massive price uptick over the last 24 hours gave investors hope for a longer bull rally.

Hence, it’s worth looking at what’s going on with SHIB lately.

Shiba Inu’s bulls buckle up

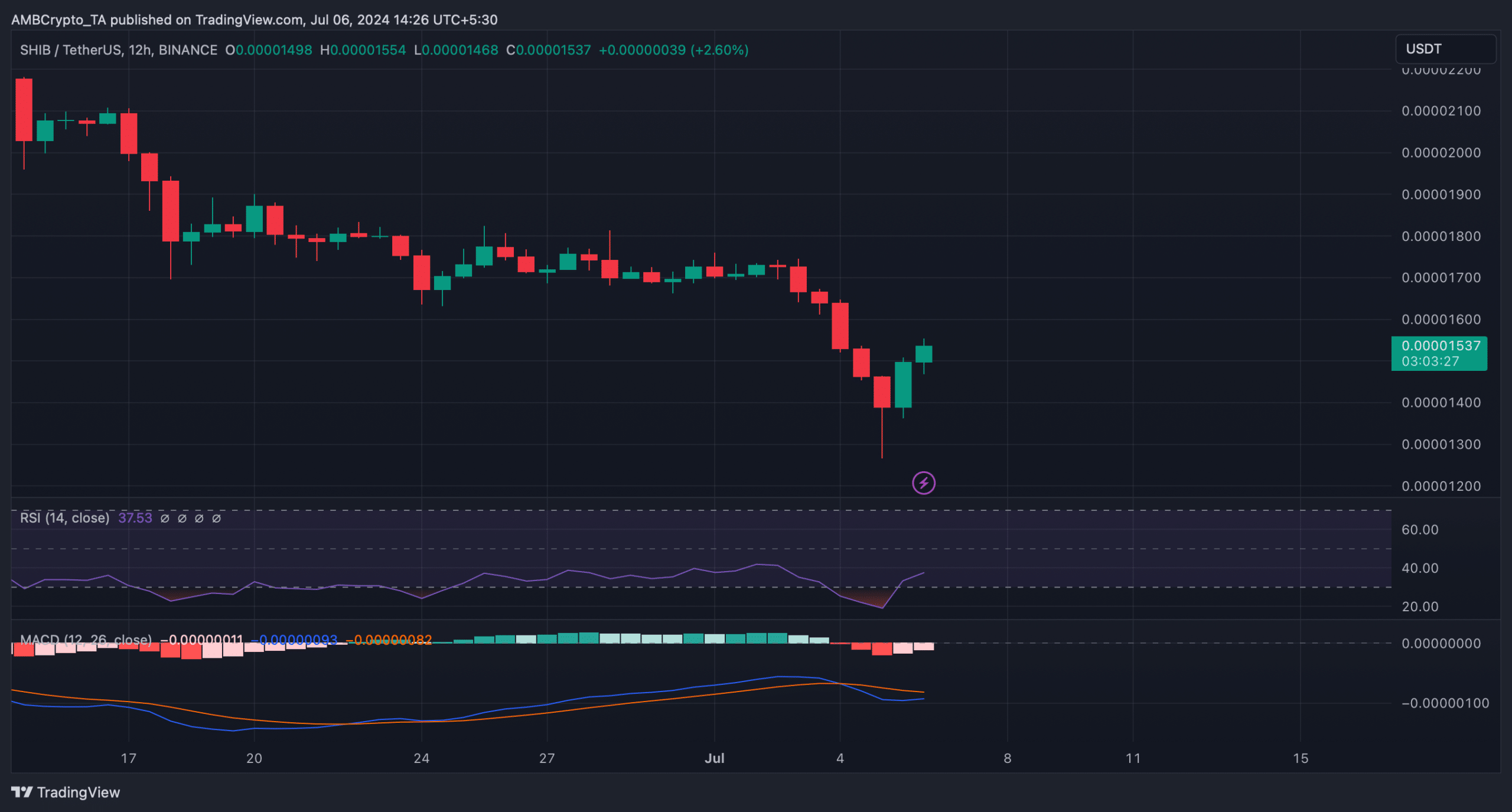

The bears dominated the market last week as they pushed SHIB’s price down to as low as $0.000013. However, the bulls have now marked their entry with a double-digit price hike. In fact, according to CoinMarketCap, the altcoin’s price rose by a whopping 17% in the last 24 hours.

At the time of writing, SHIB was trading at $0.00001543 with a market capitalization of over $9 billion, making it the 13th largest crypto.

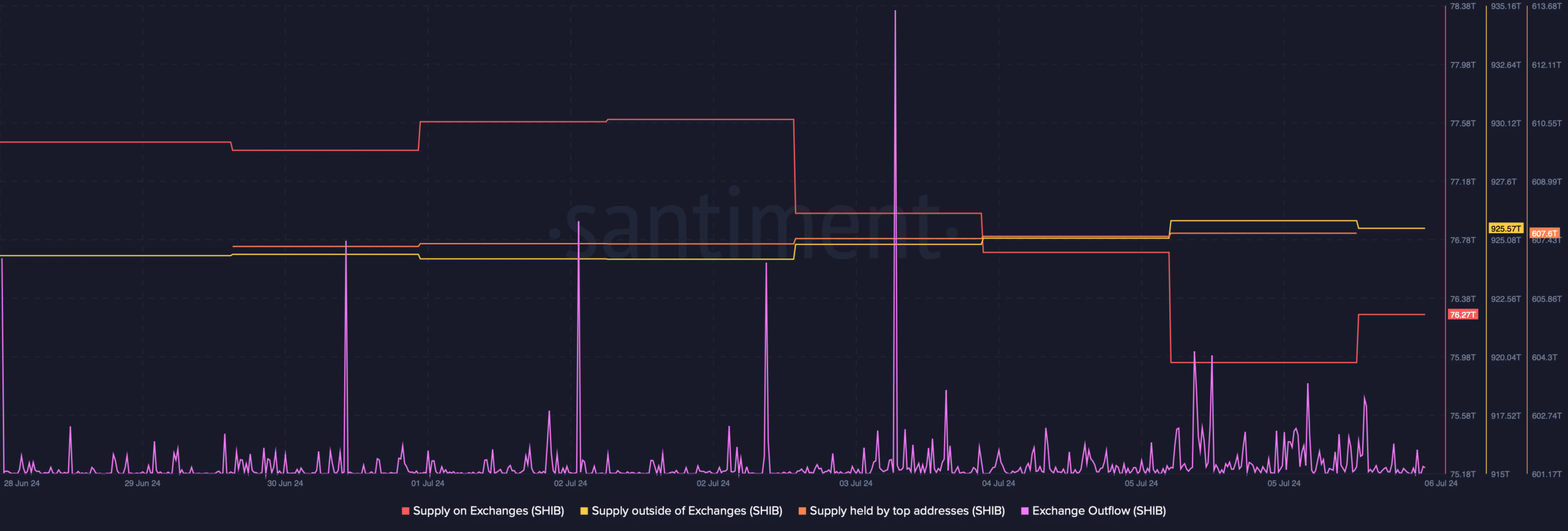

The hike in price also had a positive impact on the memecoin’s buy/sell sentiment. AMBCrypto’s analysis of Santiment’s data revealed that SHIB’s supply outside of exchanges increased while its supply outside of exchanges dropped, meaning that investors have been buying Shiba Inu. The fact that buying pressure on the coin was high was further proven by the spike in its exchange outflows.

However, the whales didn’t make significant moves last week, with the same evidenced by the flat supply held by top addresses.

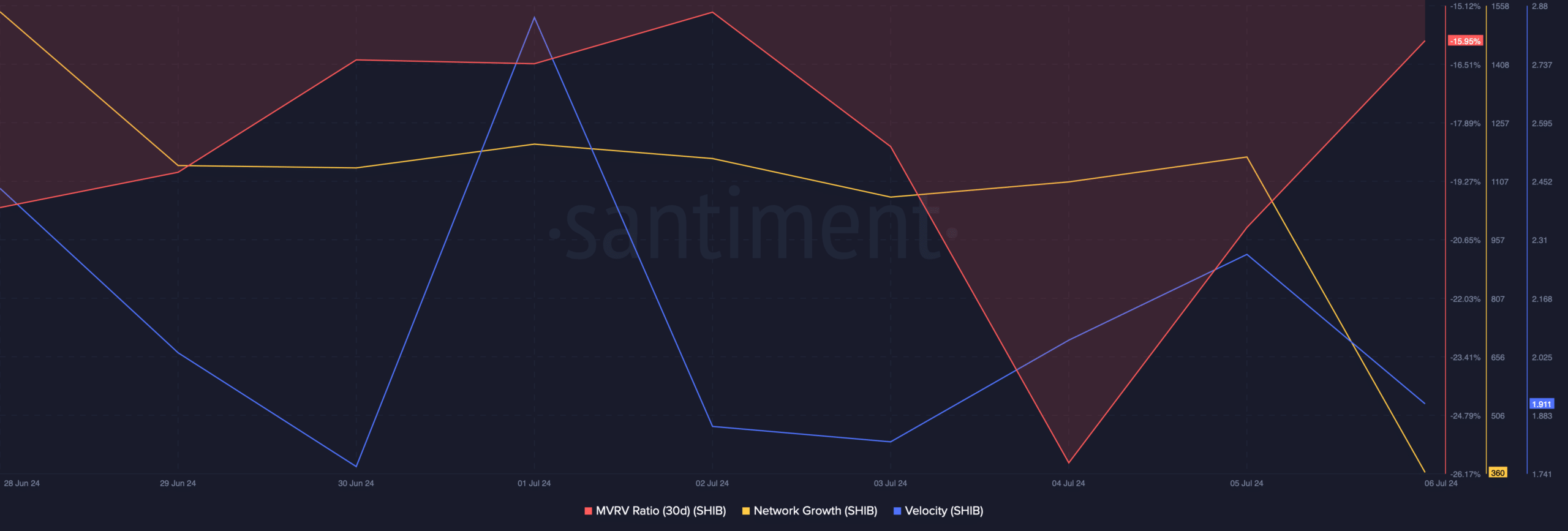

Additionally, Shiba Inu’s MVRV ratio also improved sharply on 8 July. This can be attributed to its latest price hike. However, not everything seemed to be in the memecoin’s favor.

For instance, its network growth dropped, meaning that fewer new addresses were used to transfer the token. Its velocity also dropped. A decline in this metric means that SHIB has beenp used less often in transactions within a set timeframe.

Will SHIB’s rally last?

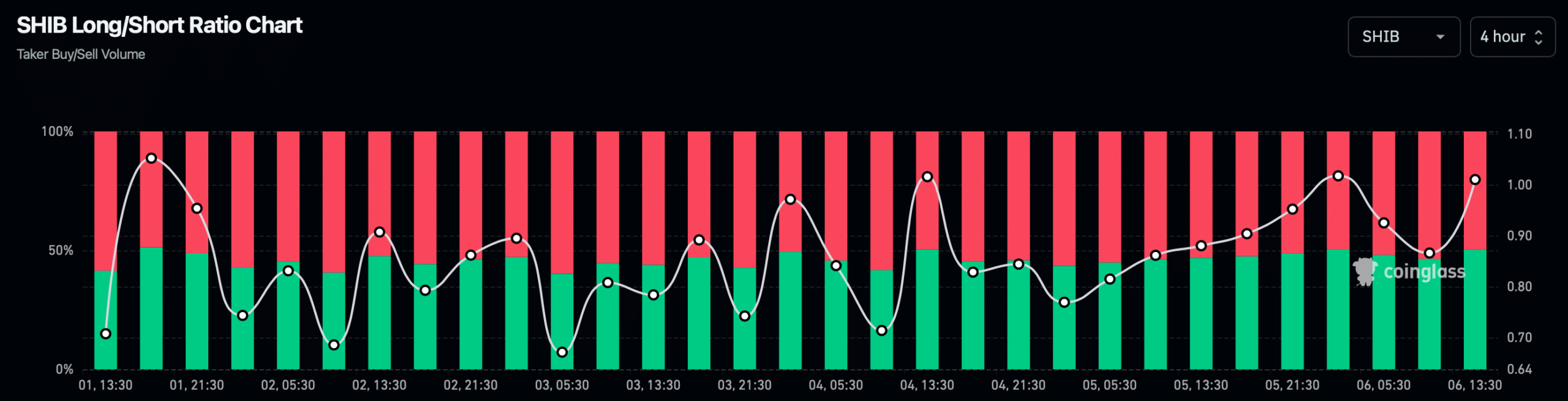

To better understand what to expect from the memecoin, AMBCrypto checked its derivatives metrics. Our analysis of Coinglass’s data revealed that SHIB’s long/short ratio registered a sharp uptick.

A long-short ratio that has risen indicates that more long positions are being held relative to short positions. What this reading indicates is that bullish sentiment is prevalent across the market.

On top of that, at the time of writing, SHIB’s fear and greed index had a value of 31%, meaning that the market was in a “fear” phase.

Whenever the metric hits that level, it means that the chances of a price hike are high.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Finally, the technical indicator MACD displayed the possibility of a bullish crossover.

Moreover, the Relative Strength Index made an exit from the oversold zone. This can be interpreted to be a bullish signal for the cryptocurrency.

)