Bussiness

Post delisting, Monero [XMR] surges nearly 5%: Is $190 here?

![Post delisting, Monero [XMR] surges nearly 5%: Is $190 here? Post delisting, Monero [XMR] surges nearly 5%: Is $190 here?](https://ambcrypto.com/wp-content/uploads/2024/07/XMR-GLADYS-1000x600.jpg)

- XMR surged by 4.39% in the last seven days.

- The recovery from delisting and regulatory hurdles could push XMR towards $190.

For the last six months, Monero [XMR] has suffered from delistings by various exchange platforms. In February, Binance [BNB] announced plans to delist XMR from its exchanges.

Next, on the 10th of June, Kraken announced the delisting of Monero in Ireland and Belgium after doing the same in the U.K.

This move by Kraken and Binance to delist privacy-centered coins XMR indicates the regulatory challenges facing cryptocurrencies.

Within Europe, with the passing of AMLR, privacy coins will cease to exist in the market. The delisting from these platforms has considerably affected XMR’s market growth and price stability.

XMR recovers post delisting

Despite the hostile environment, XMR has sustained a recovery in the last month. In the last 30 days, XMR has gained by 12.20% while recording 4.39% over the previous seven days.

In the last 24 hrs, XMR’s trading volume has surged by 7.61% to $52M.

The recovery has left everyone optimistic, with crypto analysts predicting a run-up to $190. According to one crypto analysts, Sebastian, XMR is set for a sustained price rise. He shared on X (formerly Twitter) that,

“Monero (XMR) is showcasing significant market promise, gaining momentum off the 20-day EMA at $165. With potential targets of $180 and possibly $190, XMR’s resilience underscores its key role in the crypto ecosystem.”

Crypto | ChartMonkey also shared his long-term projections, stating that,

“Monero top cycle: Expect a breakout towards the all-time high in May 2025. This sturdy coin has strong potential for exceptional performance. DYOR”.

What fundamentals tell us

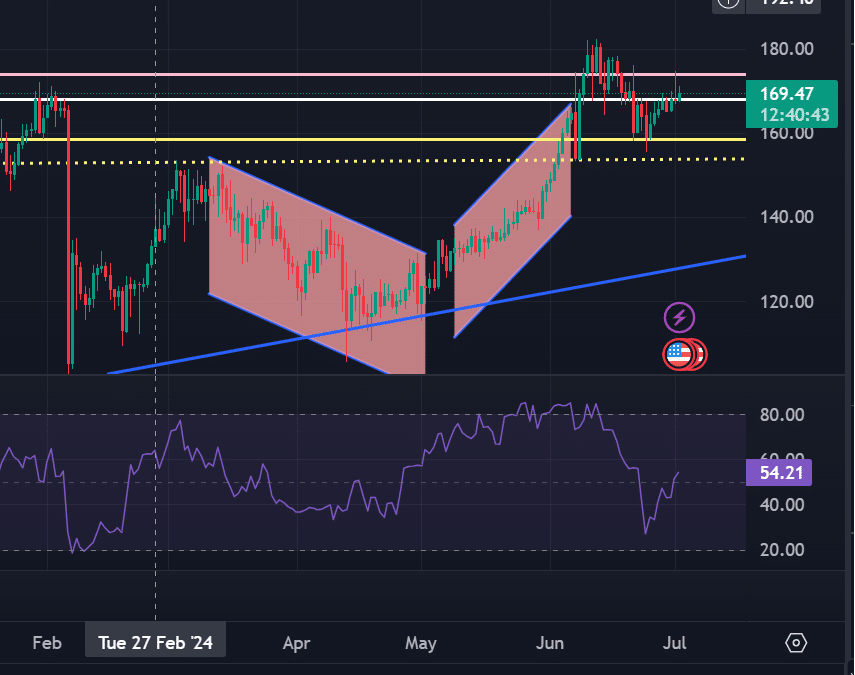

AMBCypro’s analysis showed that the market sentiment remained positive at press time. According to Market Prophit, the crowd sentiment was positive at 0.089, and Buzz’s score was 1.0853.

The Money Flow Index (MFI) has also risen from 26 to 54 in the last seven days.

The rising MFI indicated increasing buying pressure, turning the market sentiment towards a bullish outlook and increasing money flow into the altcoin.

Also, the RSI has risen from 48 to 55 in the last seven days. This sustained RSI rise indicated that the recent gains were outpacing losses, which could suggest increasing bullish momentum.

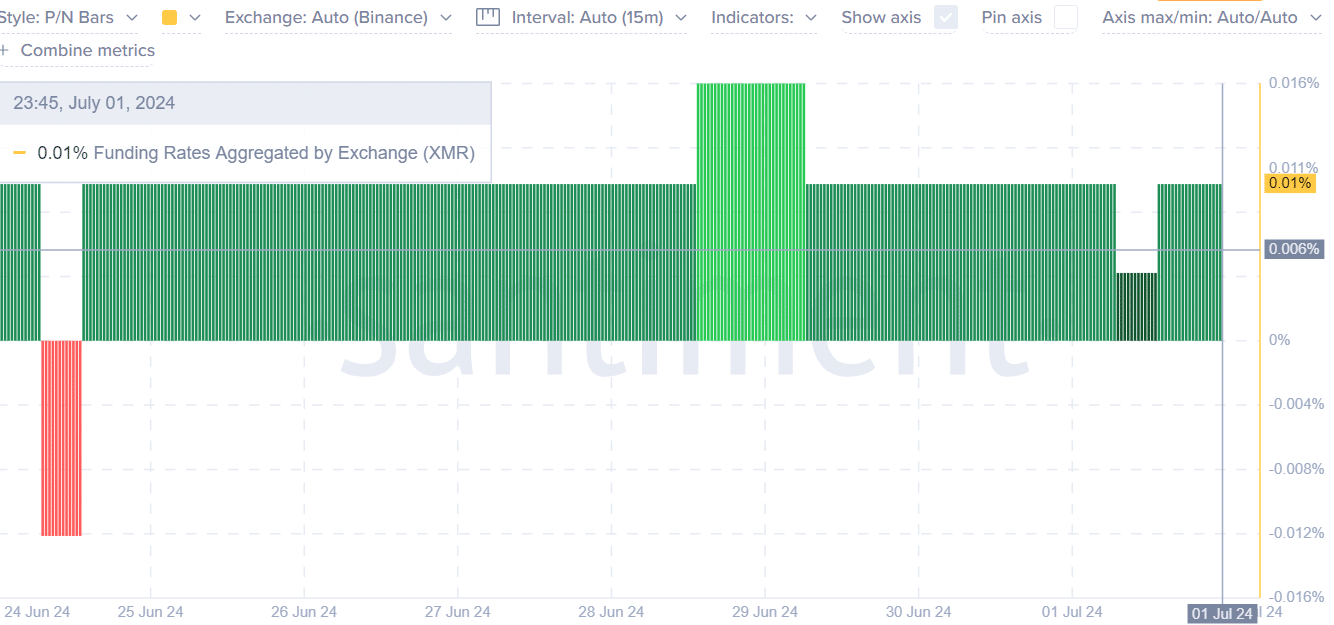

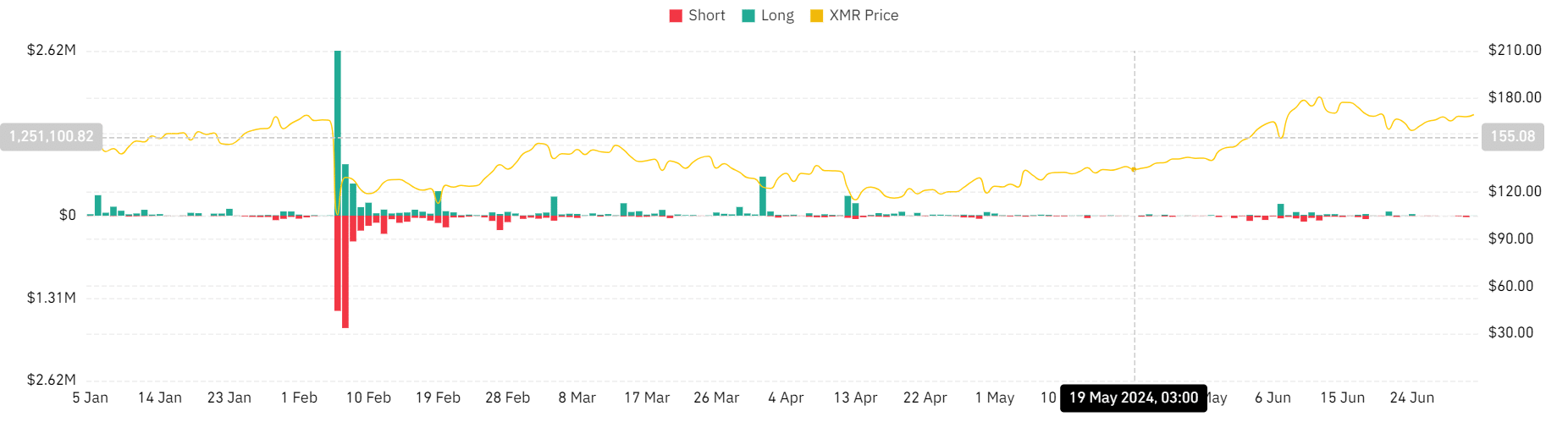

Also, AMBCrypto’s look at XMR’s sentiment showed that the Funding Rate aggregated by exchange has been positive for the last seven days.

At press time, XMR’s Funding Rate aggregated by the exchange was 0.01, implying that investors were willing to pay a premium to hold long positions, which shows confidence in future prices.

Finally, according to Coinglass, XMR has reported little or no liquidation for both long and short positions.

Low liquidations show that long position holders were holding their positions at press time, and few investors were betting against the market for short positions.

Read Monero’s [XMR] Price Prediction 2024-25

Can XMR sustain the recovery?

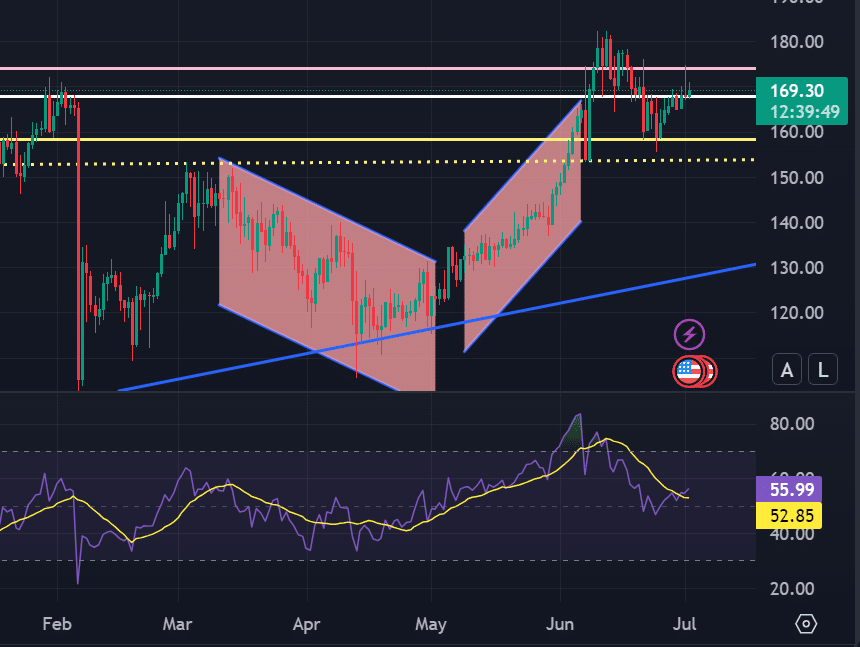

XMR traded at $169.03 at press time after breaking out of the $168 resistance level. The breakout signaled a rise to the next significant resistance level, around $174.

In a more bullish scenario, XMR will reach $179 in the short term. However, in case of market correction, it will decline to critical support at $158.

)