Bussiness

How Bitcoin grabbed $1.9B of $2B weekly crypto inflows

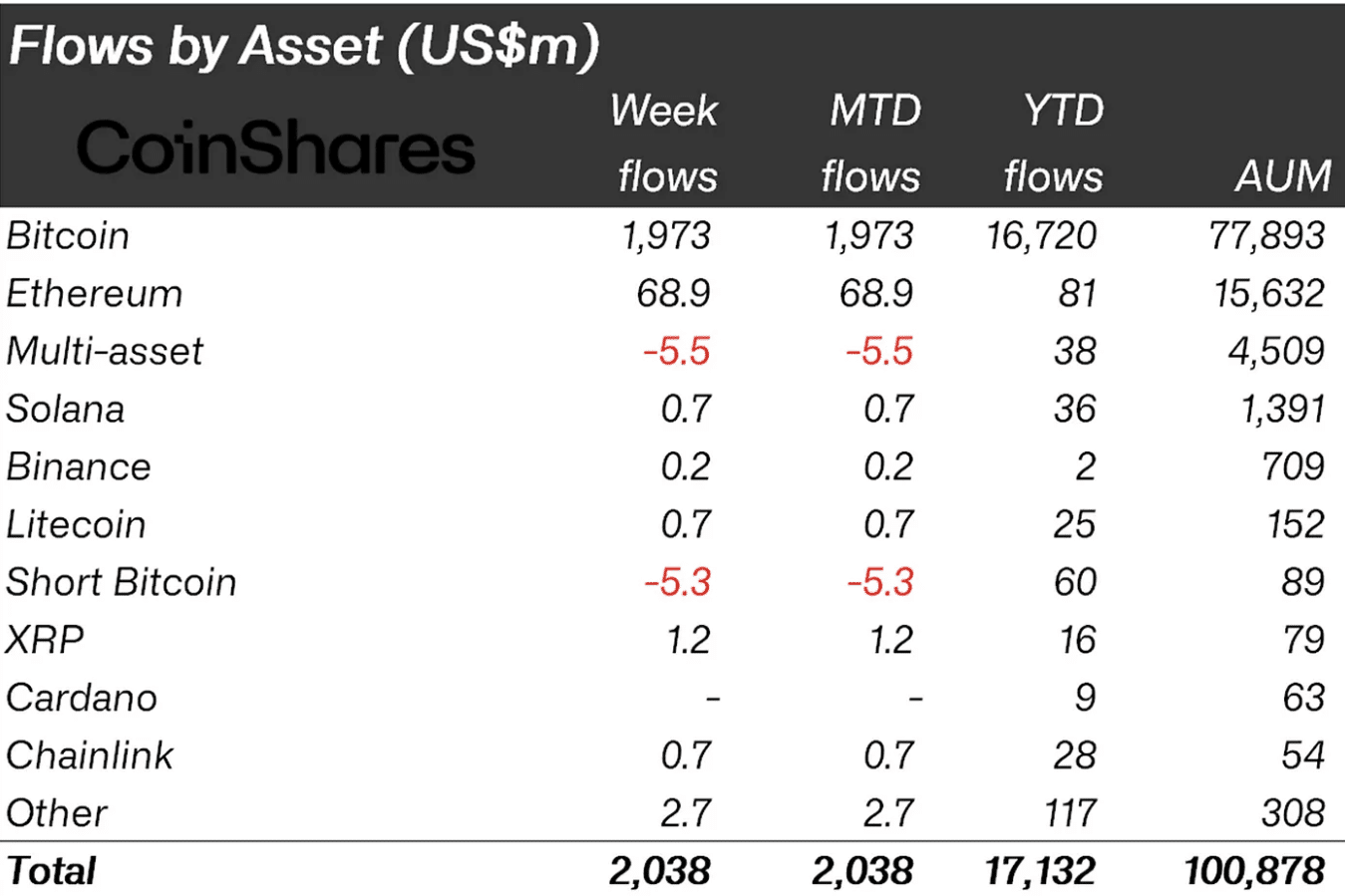

- Bitcoin investments were worth $1.97 billion while ETH accounted for $69 million.

- Short-term holders are unconvinced about a Bitcoin’s price increase.

$2 billion! That was the value of the total investments put into crypto products last week, CoinShares revealed. According to the report, Bitcoin [BTC] investments were worth about $1.97 billion.

Ethereum [ETH] also added to the capital, with a $69 million input. This was the highest inflow the altcoin had registered since the peak in March.

BTC is not entirely back

For those unfamiliar, CoinShares releases the report every week. The publication aims to cover investment referencing digital assets including cryptocurrencies.

During the previous week, Bitcoin, as well as ETH, was in the spotlight. With the dominance again, it seemed that investors were confident in the short and long term potential of the coin.

However, James Butterfill, CoinShares’ Head of Research, revealed a few reasons for the focus on Bitcoin. According to Butterfill, the positive macro data announced last week played a significant part. He wrote that,

“We believe this turn around in sentiment is a direct response to weaker than expected macro data in the US, bringing forward monetary policy rate cut expectations. Positive price action saw total assets under management (AuM) rise above the US$100bn mark for the first time since March this year.”

Despite the improvement, BTC traded sideways for most of the last seven days. At press time, Bitcoin’s price was $69,373.

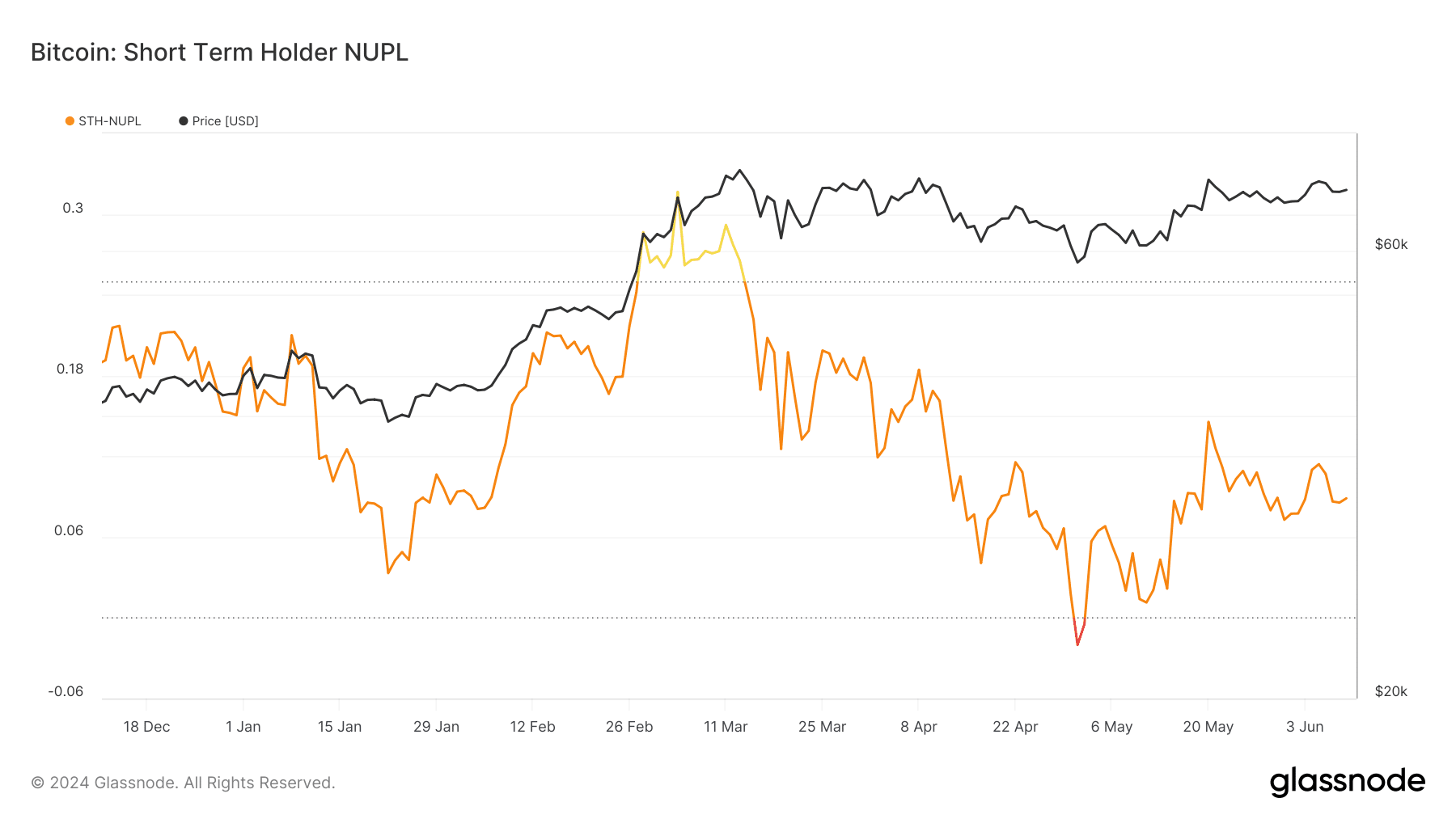

AMBCrypto looked at the STH-NUPL to assess the behavior of short-term investors. STH-NUPL stands for Short Term Holder- Net Unrealized Profit/Loss.

Price may continue to move sideways

This metric considers the sentiment BTC holders who have held the coin for less than 155 days have. At press time, the reading of the metric was 0.085, and in the hope (orange) zone.

This condition meant that most short-term holders were not confident that Bitcoin’s price would increase in the short term. Therefore, demand for the coin might not be intense, suggesting that the price might continue to move sideways.

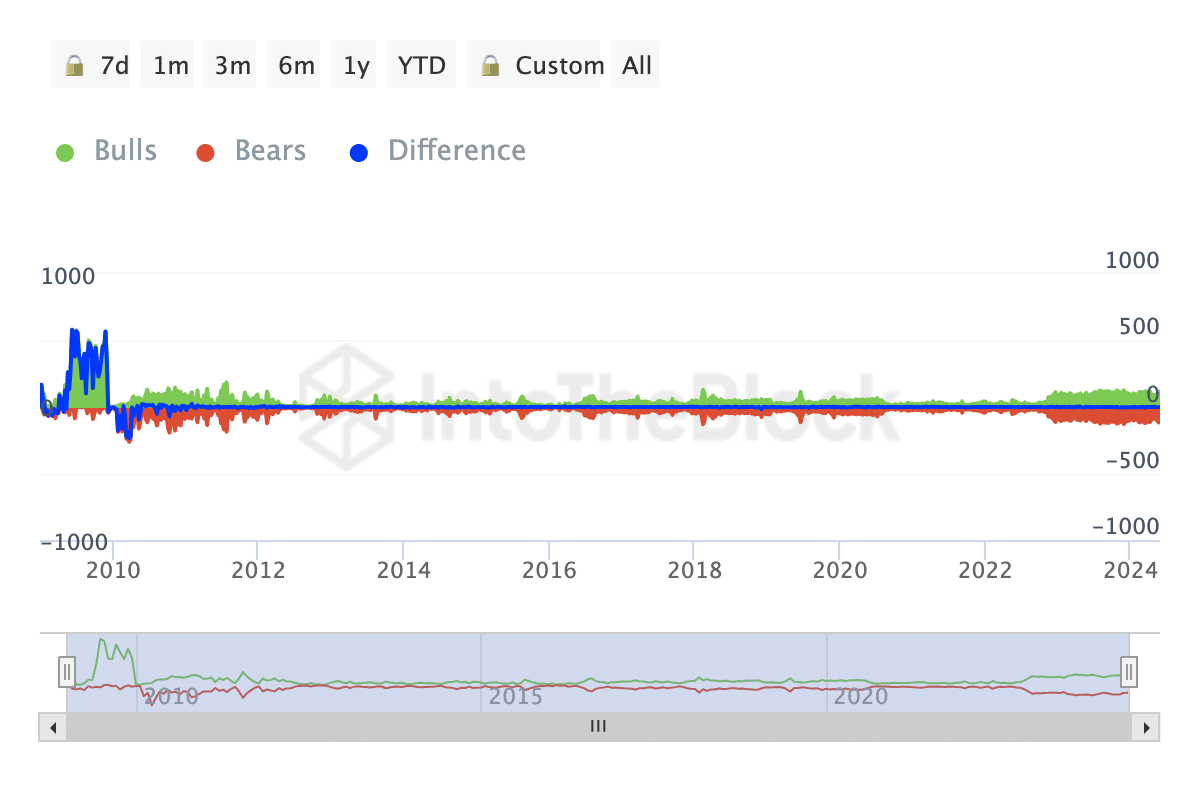

In terms of the price, AMBCrypto analyzed the Bulls and Bears indicator provided by IntoTheBlock. This metric tracks the activity of addresses that bought or sold 1% of the trading volume in the last 24 hours.

If the reading is in favor of bulls, it means that most of the volume were buy orders. On the other hand, a bearish dominance indicates an increase in selling pressure.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

For Bitcoin, the Bulls and Bears indicator was zero as of this writing. Therefore, this neutrality could cause BTC to keep trading in a tight range in the meantime.

By the look of thing, a bearish market condition could send BTC to $68,000. However, if things get better in the market, the coin could jump to $71,000 again.

)