Bussiness

Good news for XRPL is not always good news for XRP’s price – Why?

- The XRP Ledger [XRPL] saw an uptick in network activity in Q1.

- This led to a growth in its quarterly revenue.

The XRP Ledger [XRPL] saw a spike in quarterly user demand between January and March, Messari found in a new report.

In its report titled “State of XRP Ledger Q1 2024,” the onchain data provider found that during the 90-day period, the demand for XRPL surged, pushing its quarterly revenue to a yearly high.

The average daily count of addresses that completed at least one transaction on the blockchain during the quarter totaled 41,000. This represented a 37% uptick from the 30,000 recorded in average daily active addresses on XRPL in the last quarter of 2023.

The increase in the number of active addresses on the blockchain resulted in a rally in the number of transactions executed on it in Q1. According to Messari, average daily transactions on the network went up by 113% during that period.

Interestingly, there was a decline in the number of new addresses created on XRPL during the quarter under review. According to Messari:

“This QoQ decrease is because of the unusually high amount of addresses created in Q4 when the inscription activity began. On an annual scale, quarterly new addresses increased 29.8% from Q1 2023 to Q1 2024. Deleted addresses increased by 55.9% QoQ to 33,000. The deletions came as inscription activity died down.”

However, this did not impact the network’s quarterly revenue. Between January and March, XRPL’s revenue denominated in dollars totaled $205,000, climbing to a yearly high.

The network’s revenue valued in its native token XRP amounted to 350,000 XRP, climbing by 10.3% during the quarter under review.

XRP returns gains, but…

At press time, XRPL’s native token, XRP, traded at $0.52. According to CoinMarketCap’s data, the altcoin has shed 2% of its value in the last seven days.

This is attributable to the steady decline in its demand by market participants. The token’s daily active address observed using a seven-day moving average has cratered by 12% in the last week, per Santiment’s data.

Realistic or not, here’s XRP’s market cap in BTC’s terms

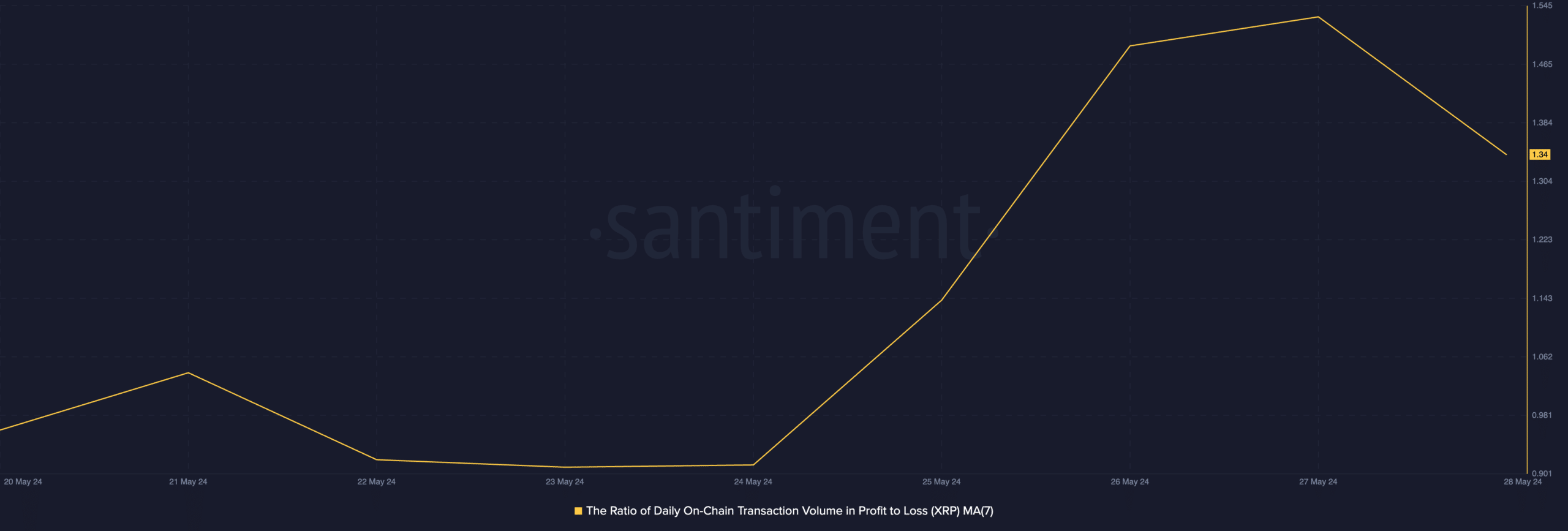

This decline in XRP demand has occurred amid the surge in the daily ratio of its transaction volume in profit to loss during the period under review.

At press time, this ratio was 1.34, signaling that for every XRP transaction that ended in a loss, 1.34 transactions returned a profit.

)