Bussiness

Examining the odds of XRP hiking by 50% to re-test its March levels again

- XRP’s price appreciated by more than 10% in the last 24 hours

- Metrics revealed that buying pressure on the token was high

XRP‘s performance over the last 24 hours has been remarkable, with its value surging by double digits. In fact, the latest price push allowed the token to break above a critical resistance level, one which could result in a further price hike in the coming days.

Hence, it’s worth looking at whether metrics supported the case for a sustained bull run.

XRP is pumping

World Of Charts, a popular crypto analyst, recently shared a tweet highlighting an interesting development. According to the same, a bullish falling wedge pattern appeared on the token’s price chart. The token has been consolidating inside the pattern after reaching its March heights.

XRP’s price hiked by more than 18% in the last seven days. In the last 24 hours alone, the token’s value surged by over 10%. At the time of writing, XRP was trading at $0.5144 with a market capitalization of over $28 billion, making it the 7th largest crypto.

Thanks to the aforementioned price action, the token managed to break above this bullish pattern. If the token continues to test the pattern, then investors might see a rise of more than 50% in XRP’s value in the coming days.

What do the metrics say?

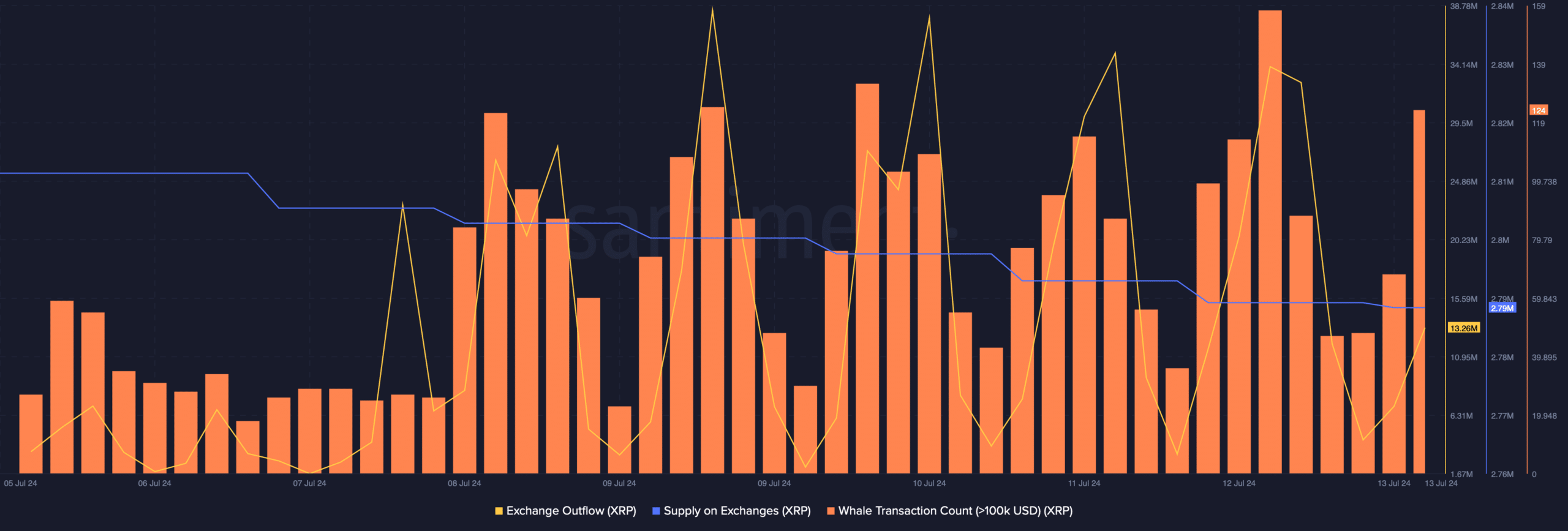

AMBCrypto’s analysis of Santiment’s data revealed that buying pressure on the token has been high. This seemed to be the case, as its exchange outflows spiked sharply too.

The fact that buying pressure on XRP was high was further proven by the decline in its supply on exchanges, meaning that investors are now accumulating more tokens. Whale activity around XRP was also high – Evidenced by the hike in its whale transaction count.

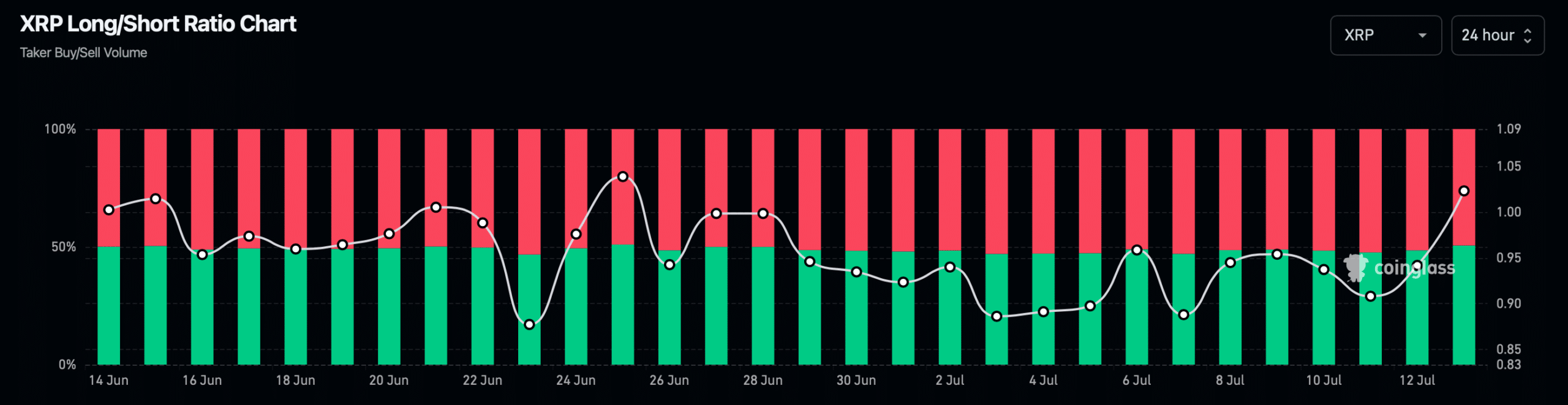

A look at Coinglass’ data also revealed that the token’s Open Interest hiked, along with its price. Generally, an uptick in the metric suggests that chances of the ongoing price trend continuing are high.

Additionally, its long/short ratio also rose. Simply put, there are now more long positions in the market than short positions – A sign of high bullish sentiment.

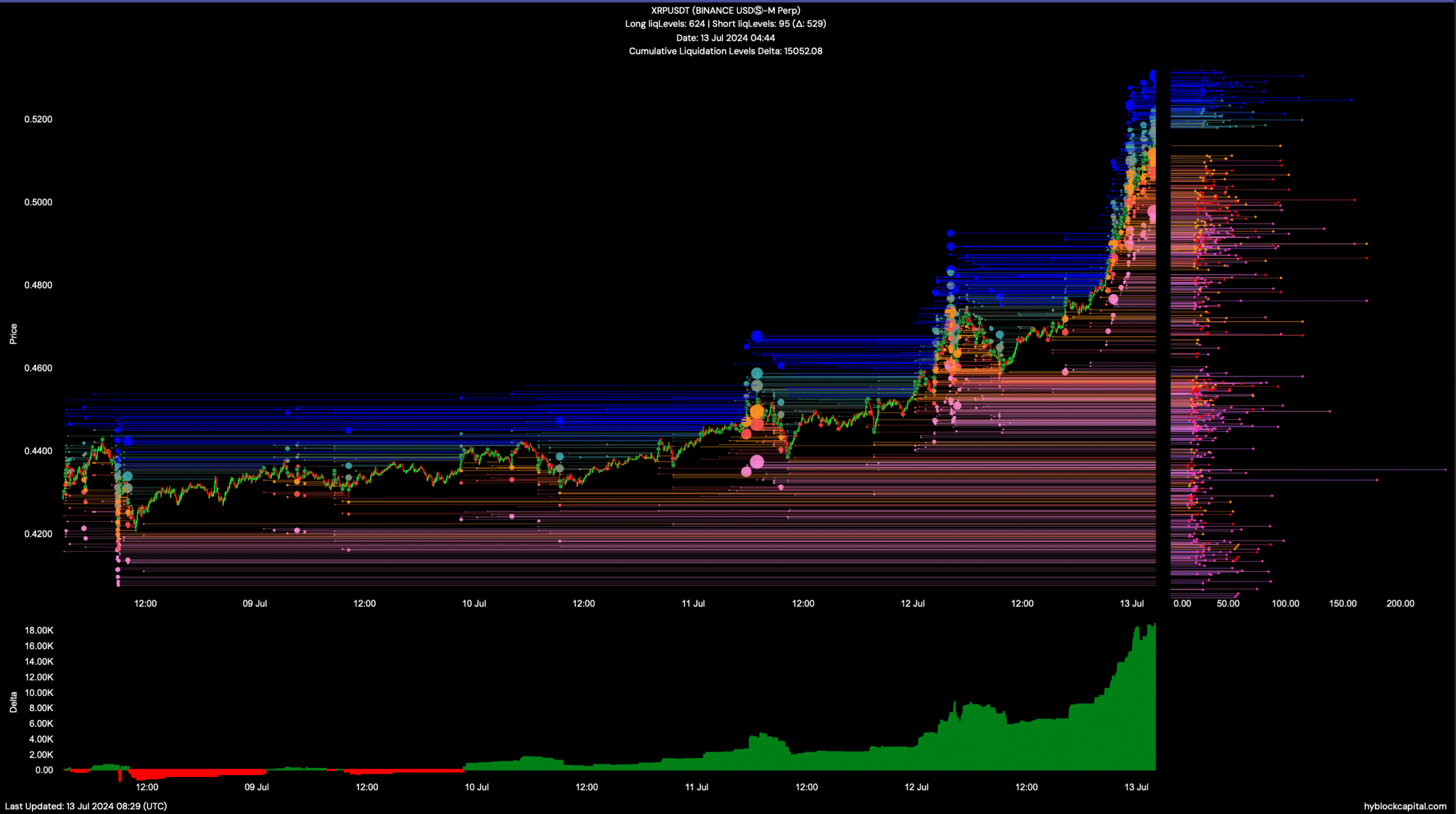

On the contrary, a look at Hyblock Capital’s data revealed that XRP’s cumulative liquidation level delta hiked significantly.

Such a massive uptick might hint at a possible market top, one which might be followed by a price correction on the charts soon.

Realistic or not, here’s XRP’s market cap in BTC’s terms

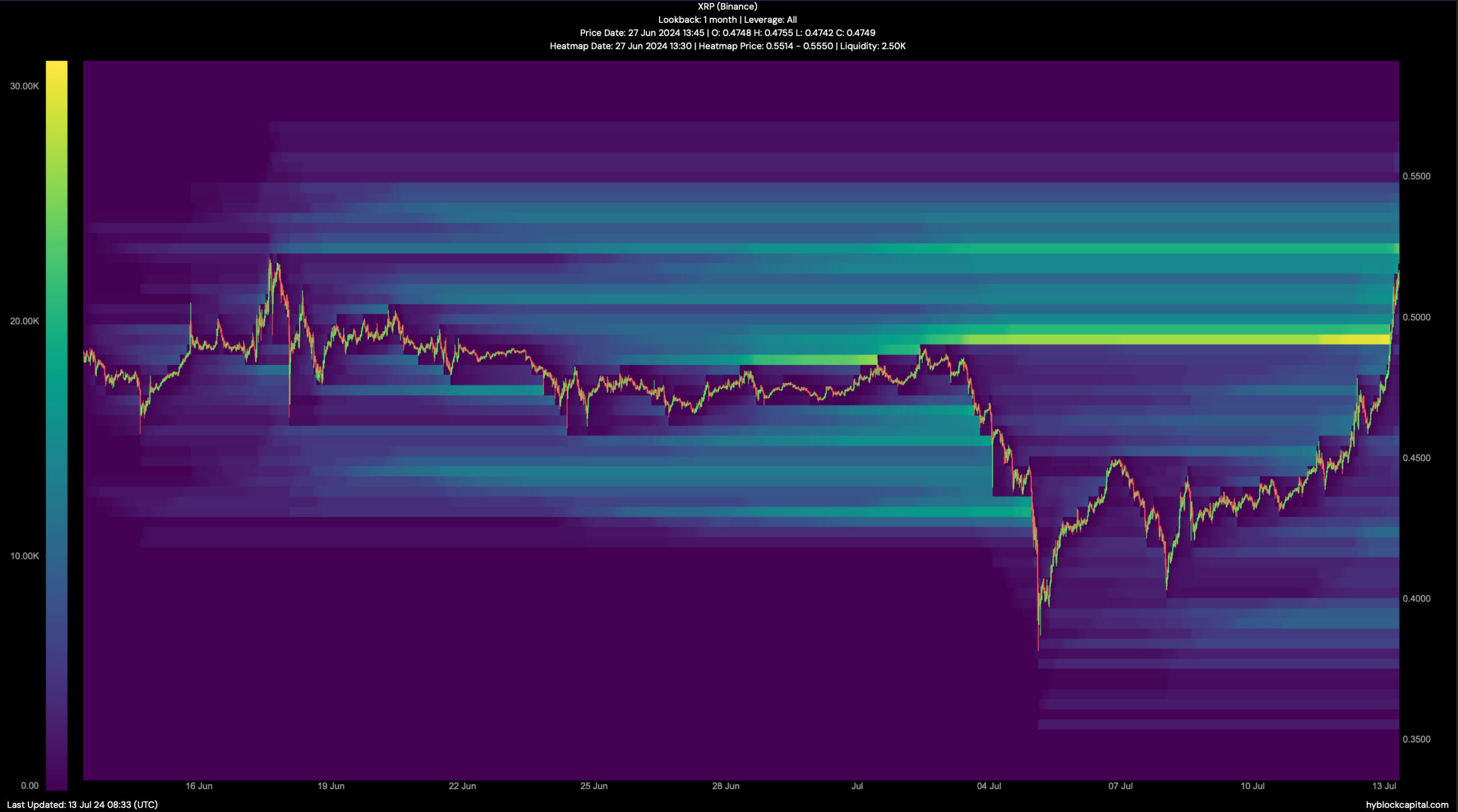

Finally, AMBCrypto checked the token’s liquidation heatmap to look for possible support and resistance zones for the token. We found that the token’s liquidation would rise to near $0.526.

A rise in liquidations often results in price corrections. However, if the bears take over the market, then the token’s price might drop to $0.42.

)