Bussiness

Ethereum: Why major investors are holding on despite ETH’s price rise

- Whales accumulated large amounts of ETH and continued to HODL.

- Retail investors showed interest in ETH as well, however, network growth declined.

The price of Ethereum [ETH] soared over the past few weeks, causing a surge in optimism across traders and holders alike. Most of these holders turned profitable due to this surge in price.

Whales begin to hold

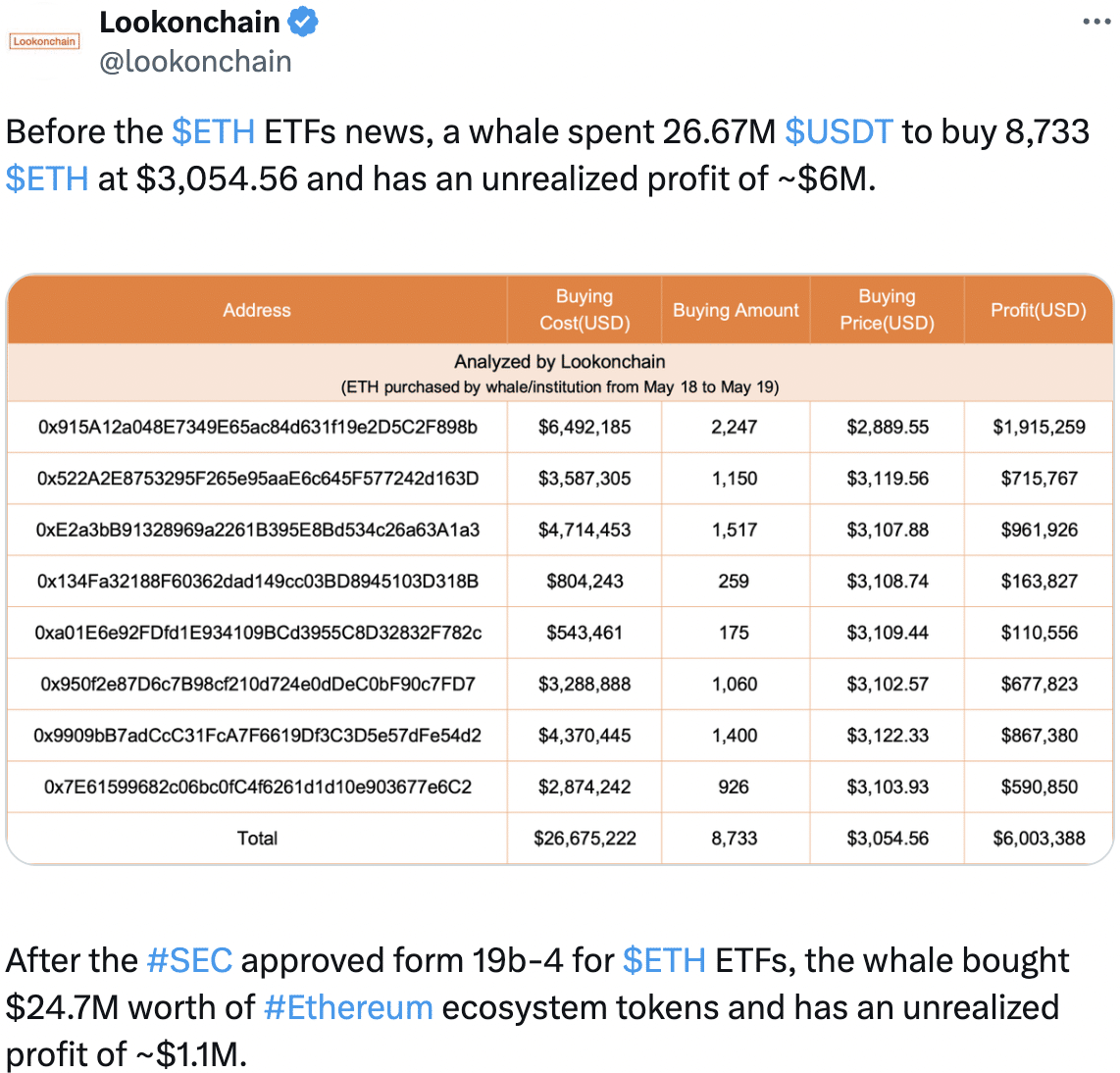

According to Lookonchain’s data, a whale has strategically placed its bets on the Ethereum ecosystem.

The particular whale accumulated a significant amount of the altcoin even before the news broke about the SEC approving ETFs tied to ETH.

This purchase consisted of 8,733 ETH at $3,054.56 per token, representing a total investment of 26.67 million USDT. As a result, at press time, the whale held an unrealized profit of 6 million dollars.

Capitalizing on the positive sentiment surrounding the SEC’s approval, the whale then dove deeper into the Ethereum ecosystem by investing $24.7 million into various tokens within the ecosystem.

The interest showcased in ETH by whales suggests that major investors see significant value in the king of altcoins, potentially leading more investors to buy in and driving the price up.

This can lead to a positive feedback loop for ETH in the future.

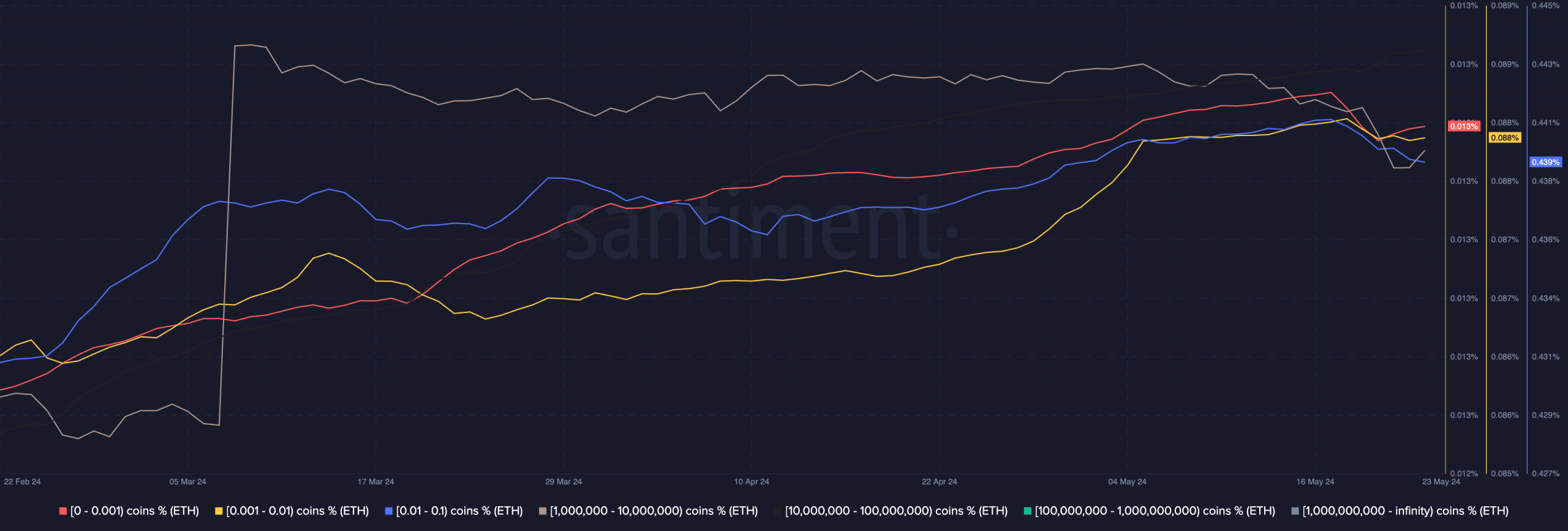

However, it wasn’t just the whales that were showing interest in ETH. AMBCrypto’s analysis of Santiment’s data revealed that retail investors were also accumulating significant amounts of the altcoin.

The cohort of addresses holding 0 to 1 ETH had showcased a massive uptick in accumulation.

With more buyers in the market, there can be upward pressure on prices.

A larger pool of ETH being traded by retail investors can increase liquidity, making it easier to buy and sell without affecting the price significantly, thereby reducing the centralization of ETH.

Is your portfolio green? Check out the ETH Profit Calculator

How is ETH doing?

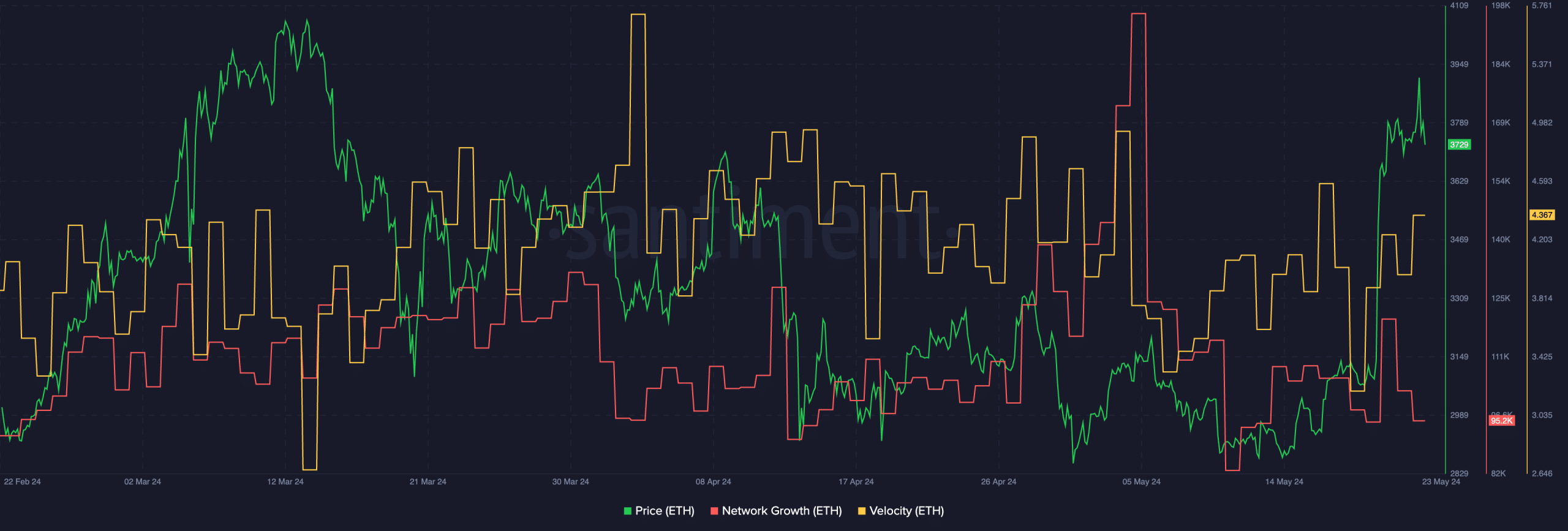

At press time, ETH was trading at $3,814.18 and its price had grown by 1.16% in the last 24 hours. The velocity at which ETH was being traded had also surged, implying a higher number of transactions.

However, Network Growth had fallen, suggesting that new users were not keen on buying the king of altcoins at its press time price.

)