Bussiness

Ethereum Name Service to halt at $27? What ENS investors need to look for

- The ENS price action showed that bears might force another rejection.

- AMBCrypto found one metric that could be key for traders to time a bullish breakout.

Ethereum Name Services [ENS] witnessed a strong rally that began on the 12th of June and continued to go strong. At press time, ENS had gained 9.82% and could go higher.

The good times might not last for the bulls, as ENS fast approached a resistance level that was unbeaten throughout 2024. Will this fourth attempt be lucky, or should bears prepare to enter short positions?

Price action shows bulls might struggle to make new highs

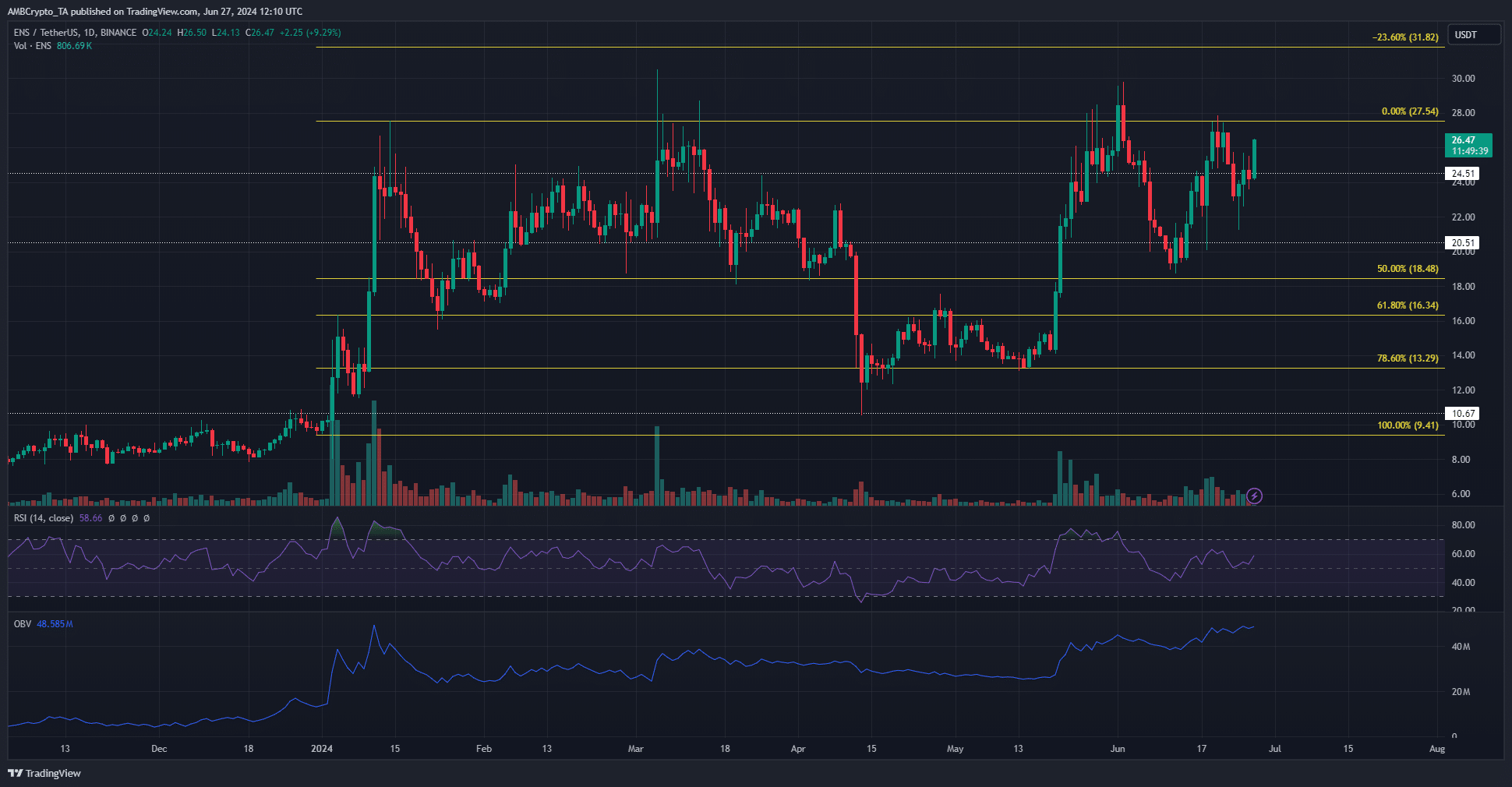

The $27.5-$28.5 zone has been a persistent resistance zone throughout this year. The first rally in January saw prices rebuffed to the 61.8% retracement level at $16.34.

However, the subsequent breakout attempt in early March also met with failure.

The retracement thereafter took ENS to $10.67, and the bulls fought through April and May to defend the 78.6% retracement level at $13.29.

Throughout this time, the OBV has trended higher. The steady buying pressure might pay off this time and force a breakout.

Network Growth was another positive sign

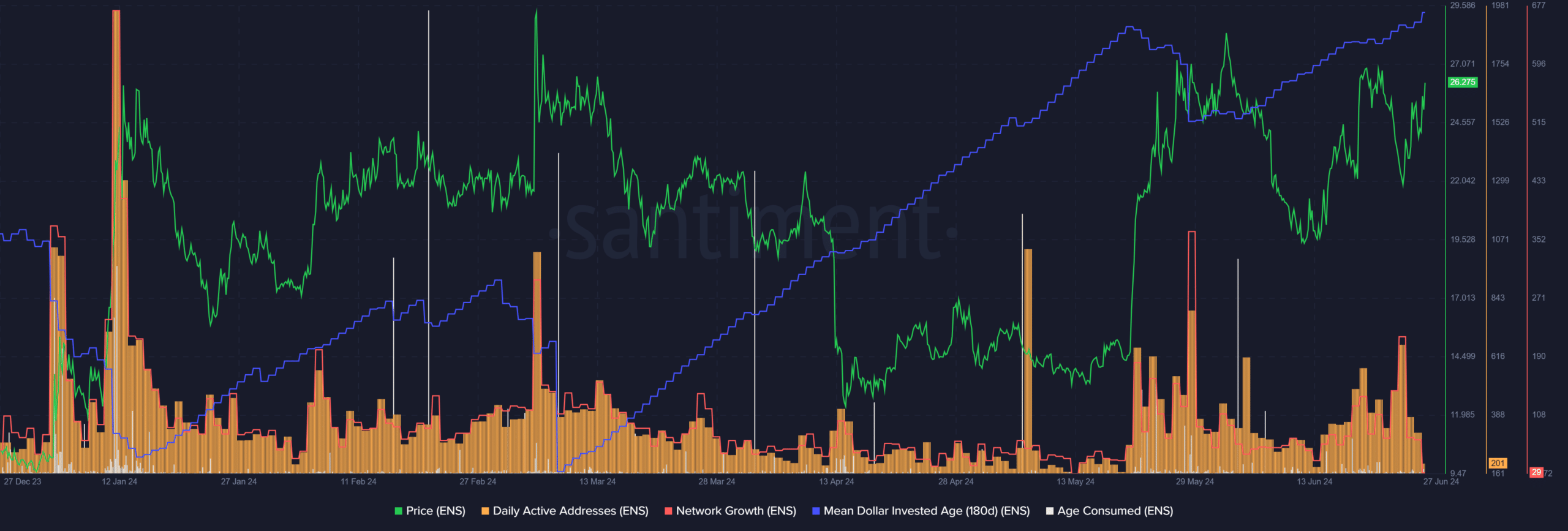

Source: Santiment

Since the 15th of June, Network Growth has trended upward to denote hundreds of unique addresses created on the network. The Daily Active Addresses has also trended upward.

Together, the rising adoption might fuel demand.

The mean dollar invested age continued to trend upward. This showed the network was becoming less active and older tokens were sticking to the same addresses.

Is your portfolio green? Check out the ENS Profit Calculator

A drop in the MDIA metric could rejuvenate the market and spark a breakout.

As things stand, bulls should be cautious of buying ENS at such a strong resistance zone. However, the $27.5 region is broken and the MDIA metric begins to trend downward, investors might want to bet bullishly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

)