Bussiness

Dogecoin’s short-term price targets – Is $0.12 on the cards now?

- Dogecoin, at press time, seemed poised to breach a critical support line

- On-chain metrics highlighted significant bearish sentiment across the market

Dogecoin [DOGE], at press time, was trading close to the lower line of its horizontal channel, within which it has trended since 13 April.

A horizontal channel is formed when an asset’s price consolidates within a range for a period of time. The upper line of this channel forms resistance, while the lower line forms support. As for DOGE, the bears seemed to have created resistance at $0.17, while the bulls defended the coin’s price at $0.12 – Forming a long-term support.

DOGE bears take charge

If the bulls fail to defend this support level, DOGE’s price could plummet to new lows on the charts. This would mean that the market has become overwhelmed by selling activity.

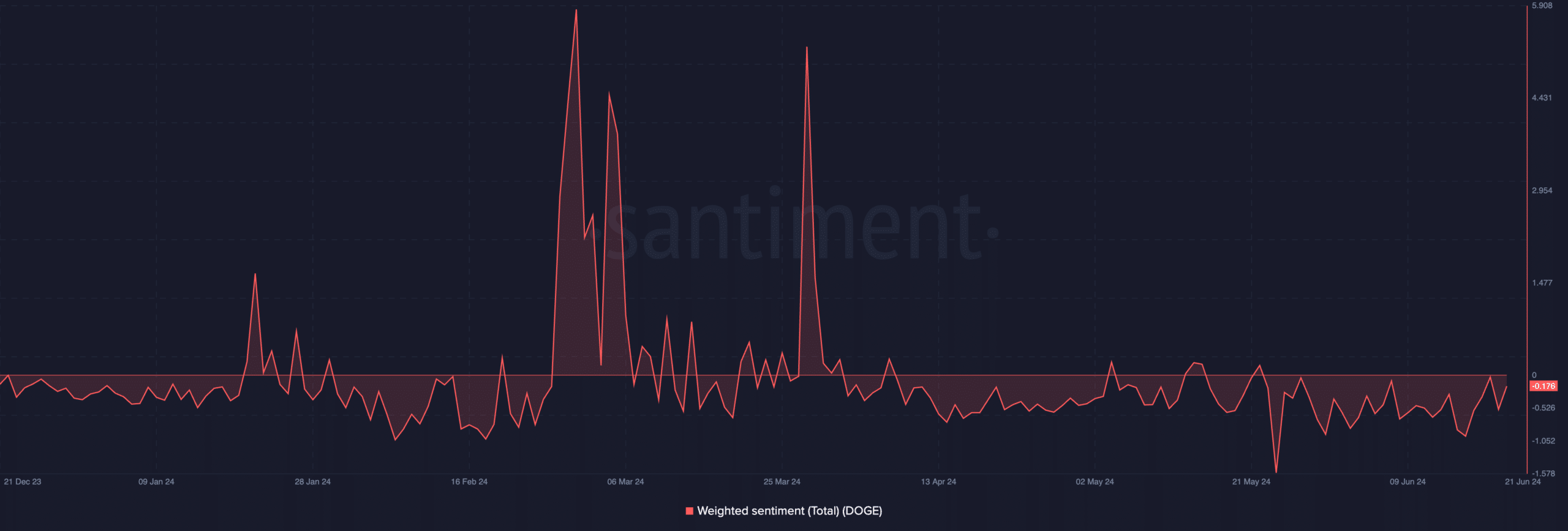

An assessment of a few on-chain metrics hinted at the possibility of this happening. For instance, the memecoin’s weighted sentiment has been primarily negative since 31 March.

This metric measures the overall mood of the market regarding an asset. When it returns a negative value, the asset’s market is overwhelmed by negative sentiment, and its price is expected to fall.

Still below zero at press time, DOGE’s weighted sentiment was -0.17. If the memecoin continues to be trailed by poor sentiment, it puts downward pressure on its price. This might cause it to fall below the support level.

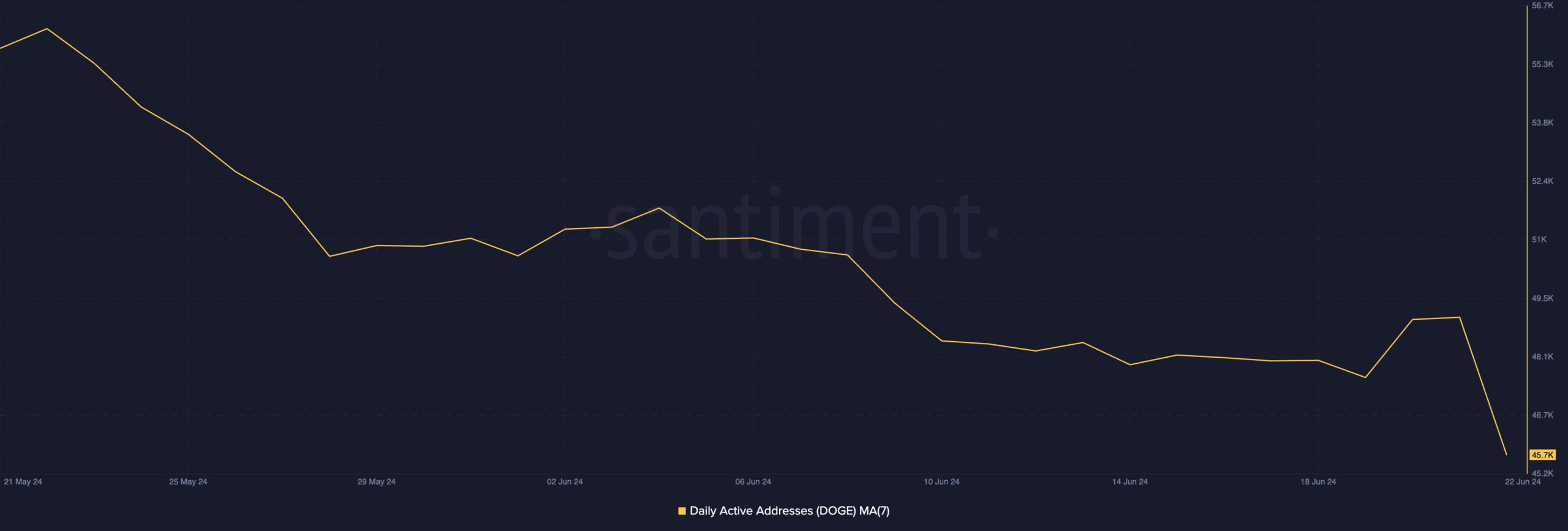

Additionally, general market demand for DOGE plummeted too. In the last 30 days alone, the average daily count of addresses that have completed at least one transaction involving the popular memecoin has dropped by 13%, according to Santiment.

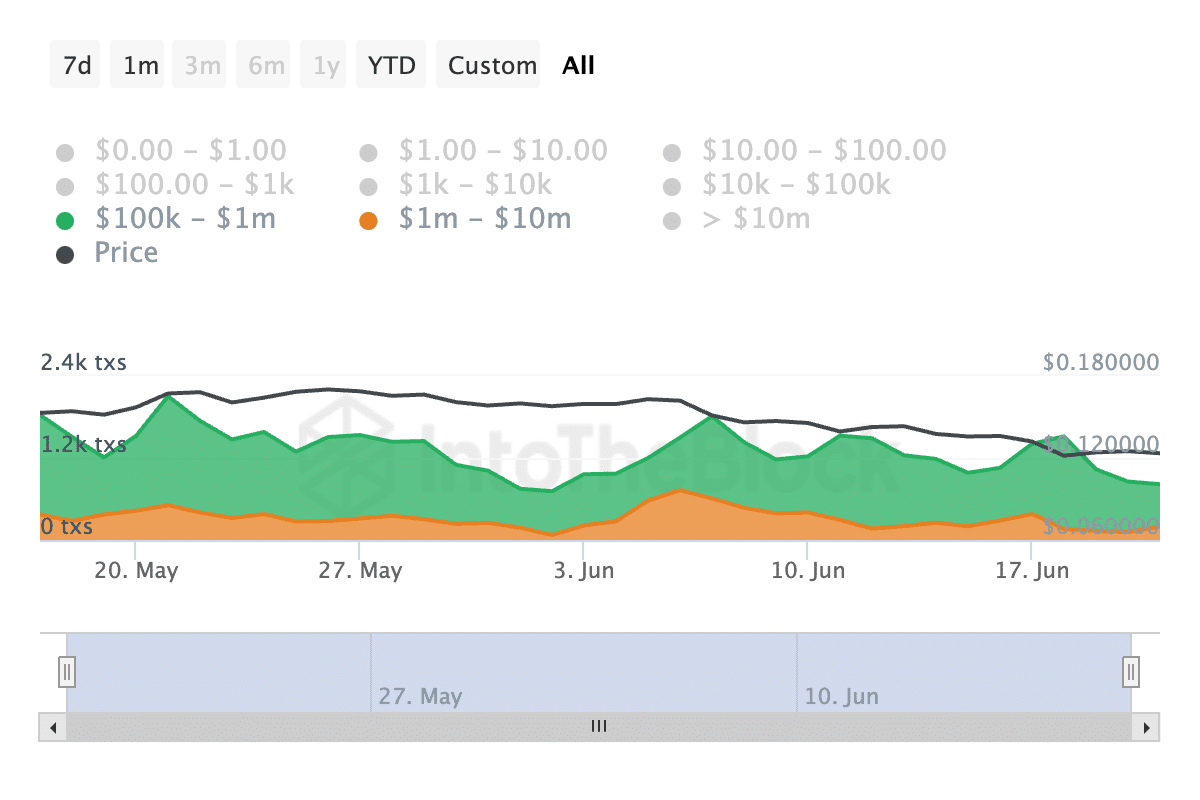

To prevent further losses to their investments, DOGE whales have gradually reduced their exposure to the memecoin over the past month. According to IntoTheBlock’s data, the daily count of DOGE’s large transactions has fallen significantly over the last 30 days.

Consider this – The number of DOGE transactions valued between $100,000 and $1 million has fallen by 46% over the past month. Likewise, larger transactions ranging from $1 million to $10 million have fallen by 39.1% during the same period.

DOGE Futures traders remain resolute

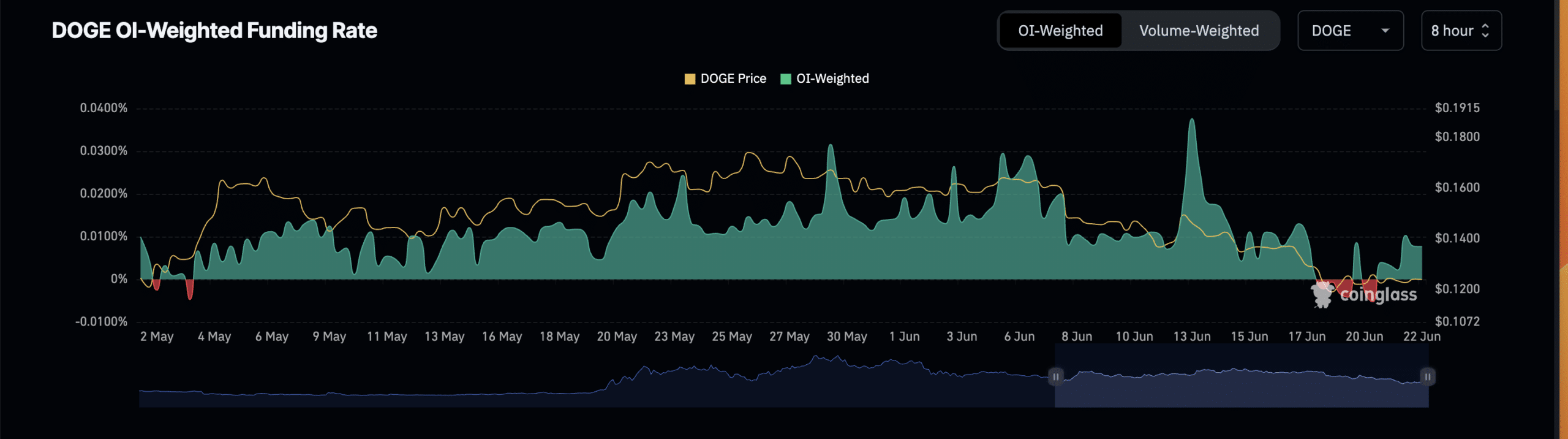

Despite Dogecoin’s poor price performance, however, its Futures traders have predominantly remained bullish.

Is your portfolio green? Check out the DOGE Profit Calculator

According to Coinglass, an assessment of the coin’s funding rate revealed that aside from the negative values recorded on 18-19 June, it has remained positive over the last two months.

Funding rates are a mechanism used in perpetual Futures contracts to ensure the contract price stays close to the spot price.

When an asset’s funding rate is positive, it suggests that there is more demand for long positions. This means that more traders are buying the coins in expectation of a price rally, than those buying in anticipation of a decline.

)