Bussiness

Bitcoin’s price – Are we still in the bull market? Analyst says…

- CryptoQuant analyst believes Bitcoin traders are still in a bull market, despite the recent price drop

- Miners revenue for Bitcoin declined materially over the last few days

Bitcoin [BTC] seemed to be stagnating around the $66,000 mark, at the time of writing. And yet, despite its iffy price action, the outlook for the world’s largest cryptocurrency remains as positive as ever.

Bull run season?

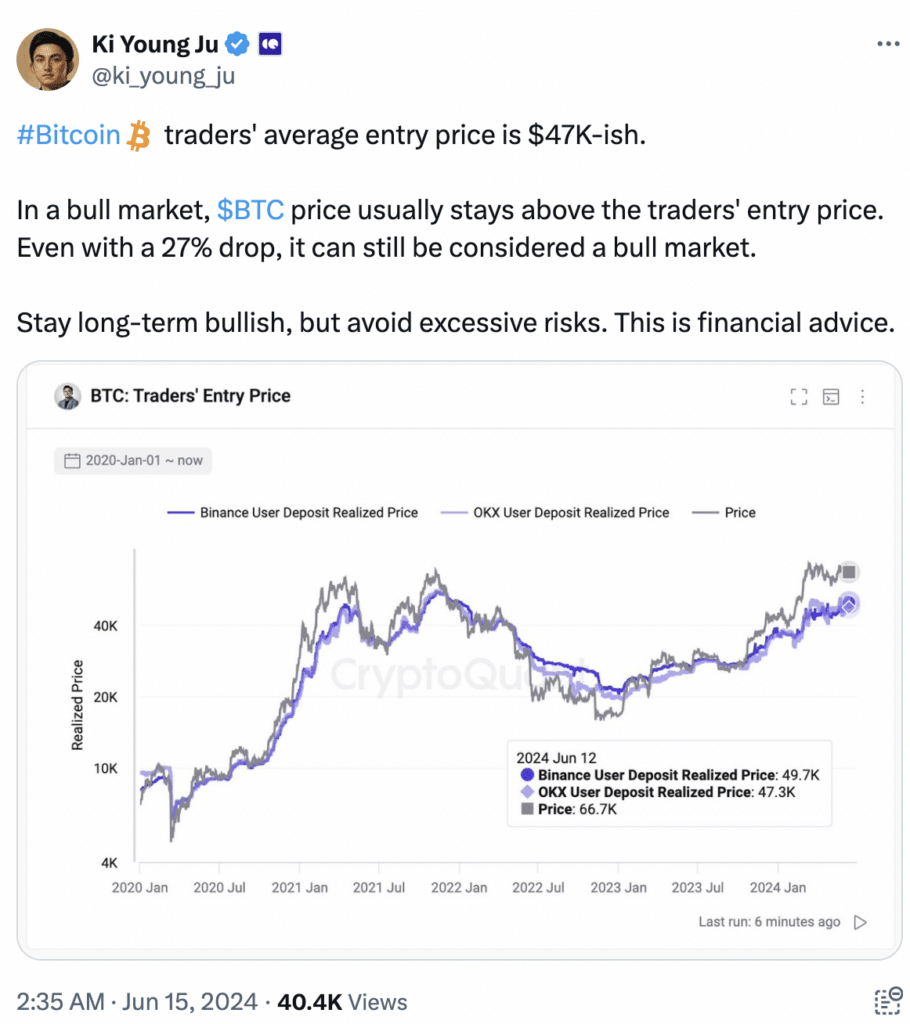

CryptoQuant analyst Ki Young Ju believes Bitcoin traders are still in a bull market, despite the recent price drop. His optimism stems from the fact that the average entry price for Bitcoin traders is around $47,000. This means that even though BTC is down around 27% from its all-time high, most Bitcoin traders are still sitting on profits and haven’t been forced to sell.

For his part, Ki Young Ju interprets this data as a sign of sustained bullish sentiment. Historically, in bull markets, the price of Bitcoin tends to stay above the average entry price of traders.

This is a sign that many traders are likely waiting for the price to rise again, before selling. It’s worth noting, however, that the analyst also advised caution, recommending a long-term bullish approach while avoiding excessive risks in the current volatile market.

Most of these addresses holding BTC are long-term holders. Long-term holders are those who buy Bitcoin with the intention of holding it for an extended period, often years or even decades. They are typically less fazed by short-term price fluctuations, focusing instead on the potential for Bitcoin’s value to grow over the long haul. This is reflected in the current average entry price.

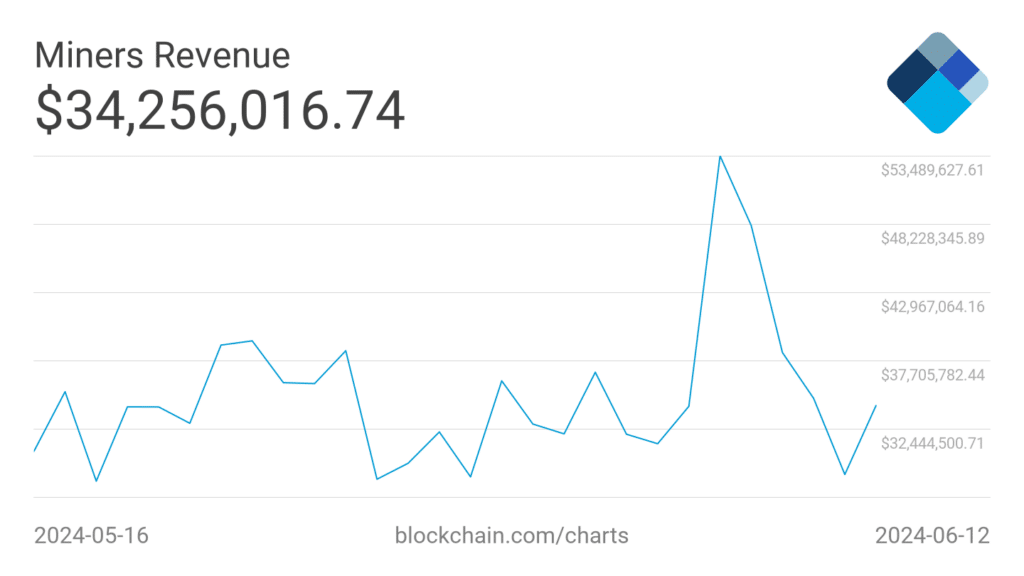

Another factor that could influence the price of BTC could be the state of the industry’s miners. Over the last few days, the daily revenue generated by miners has declined significantly from 53 million to 34 million. If the revenue generated by the miners continues to decline, it will become difficult for the miners to remain profitable.

In such a case, they would be forced to sell their BTC holdings, contributing to selling pressure on BTC and by extension, a further decline in price.

A fall in activity and…

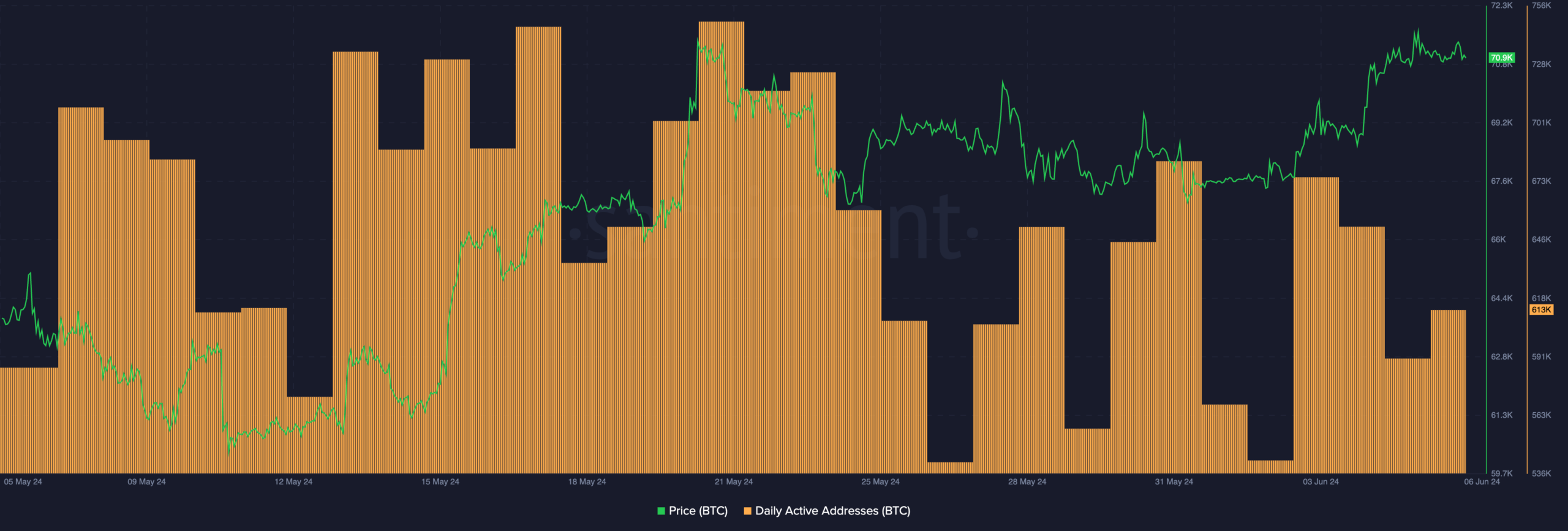

Activity on the Bitcoin network can affect the revenue generated by these miners significantly. In fact, AMBCrypto’s analysis of Santiment’s data revealed that the number of active addresses on the network climbed from 688,000 to 613,000 over the past month.

The decline in activity and falling interest in Bitcoin’s ecosystem could lend more downward pressure on BTC’s price action on the charts.

Read Bitcoin (BTC) Price Prediction 2024-2025

)