Travel

7 Best Scuba Diving Travel Insurance for Underwater Adventurers

As a divemaster, I understand that life under the water is incredible. I also understand that it poses serious risks, even if you take every possible precaution. Accidents happen, which is why scuba diving travel insurance can be a good investment.

Before you think, “I have travel insurance, so I’m set,” know that you might not be. Many travel insurance policies don’t cover what they classify as “high-risk activities,” such as skydiving, skiing, and scuba diving. Bummer. Thus, it pays to evaluate travel insurance with scuba diving cover specifically included.

How do you choose the right one? And what separates a good policy from the pack? I’m glad you asked.

The 7 Best Scuba Diving Travel Insurance Policies

Let’s get this out of the way first: Not every type of travel insurance covers scuba diving. Even those we rate as the best travel insurance plans focus on other things, such as trip delays and lost luggage. Divers likely have other concerns, though it’s possible to find hybrid policies that cover both dive-related accidents and things like damaged gear in your checked luggage.

* On top of the annual membership fee in Divers Alert Network, discussed below.

Is Travel Insurance for Scuba Diving Worth It?

Insurance: You hope you never need it. And it’s something you pay for hoping you never have to use it. Most things in life aren’t worth paying for if you’re not using them, so does that mean you shouldn’t get travel insurance for scuba diving?

Let’s consider the alternative: What if you don’t get coverage?

Depending on where you are in the world, getting to an appropriate medical facility for your diving-related accident might not be that simple. Consider that several island nations in the Caribbean don’t have a decompression chamber. When I did my divemaster course in Bayahibe in the Dominican Republic, the nearest chamber was 2 hours away by car in Santo Domingo, the capital.

As you may know, delays in treatment decrease the likelihood of positive outcomes during diving accidents. They also increase your costs. Imagine diving in Nicaragua, which doesn’t have a chamber. After a serious dive accident, you may need emergency transportation to Costa Rica to access the nearest decompression chamber. As you’ll see from our evaluation of medical evacuation insurance policies, the cost of emergency medical evacuation can surpass $10,000 faster than you can say, “How much will this treatment cost?” And skipping treatment might not be an option, regardless of the price tag.

So, while it might look like one more item to trim to keep travel costs low, the alternative to forgoing scuba diving insurance might not be worth the risk if something goes wrong.

Scuba Diving Travel Insurance Costs

Travel insurance that covers scuba diving can be broken down into 2 categories: traditional travel insurance that also covers scuba diving and scuba-focused policies that have some “regular travel insurance” elements tacked on. Thus, you’ll see familiar travel insurance companies offering plan supplements to cover scuba diving (and other adventure sports) or sports travel-themed policies from these travel insurance regulars. Conversely, you can find insurance policies that are acutely focused on scuba accident insurance while also including a few other elements on top.

Let’s start with the travel insurance companies.

Costs From Traditional Travel Insurance Agencies

To get an idea of pricing, we used Squaremouth — a travel insurance comparison website that lets you sort through hundreds of travel insurance plans — to compare plans and prices. We priced a sample trip for 2 people, ages 37 and 35, who live in Illinois and paid for their trip yesterday but are shopping for travel insurance today. They want insurance to cover their 10-day trip in September, heading to one of my favorite diving destinations: Belize.

After you fill out the destination, dates of travel, number of travelers, and ages, the final page asks for the cost of the trip and the date of the first deposit. You need to put in a price (per traveler or total trip cost) and whether the full amount of the trip has been paid for yet. You also choose whether you want your policy to cover the trip cost. This affects whether you see policies covering lost deposits for missing or canceling your trip, for example.

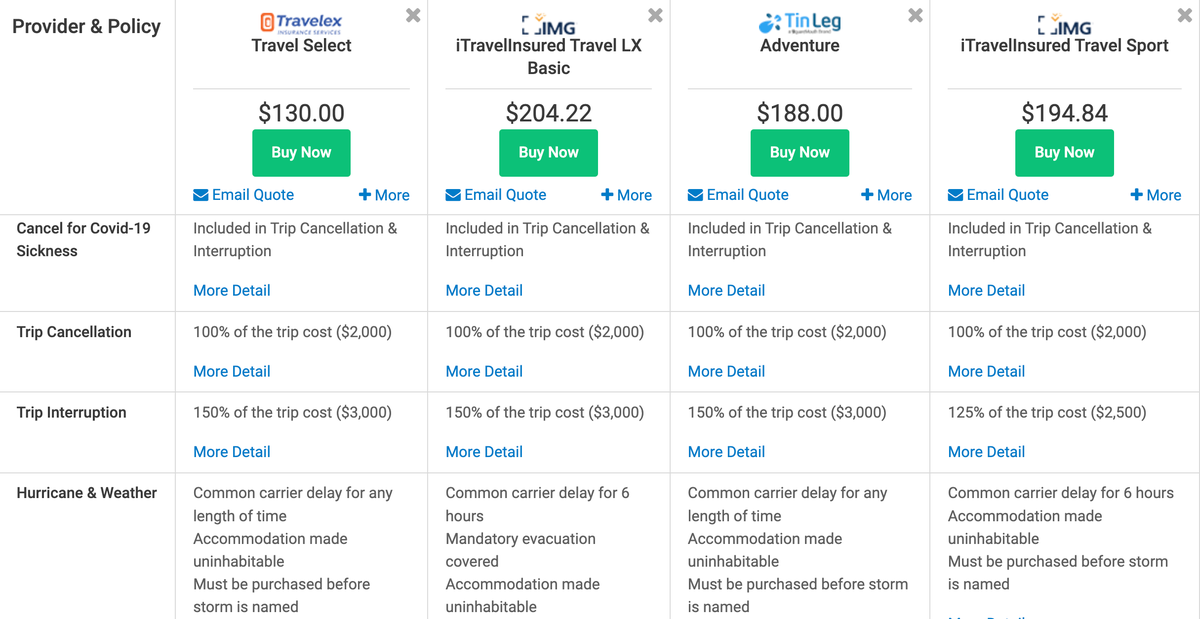

We chose “cover my trip cost” and said that the trip cost was $1,000 per person, already paid in full with a deposit date in the past 24 hours. Squaremouth returned 4 policies that met all of the criteria (covering scuba diving and trip reimbursement) for this example.

Prices range from $130 to $204.22 for these policies. All of the policies cover cancellation for COVID-19 sickness and 100% of the trip cost for trip cancellation. Three of the policies cover 150% of the trip cost (up to $3,000) for trip interruption; however, the IMG Travel Sport policy only covers up to 125% here.

Weather-related issues showed some major differences in the policies. Travelex and TinLeg cover delays of “any length of time,” while the 2 IMG policies require delays of at least 6 hours. Moreover, IMG’s Travel LX Basic policy covers mandatory evacuation. All of the policies require purchasing prior to a named storm being named, and all of them cover your accommodation becoming uninhabitable.

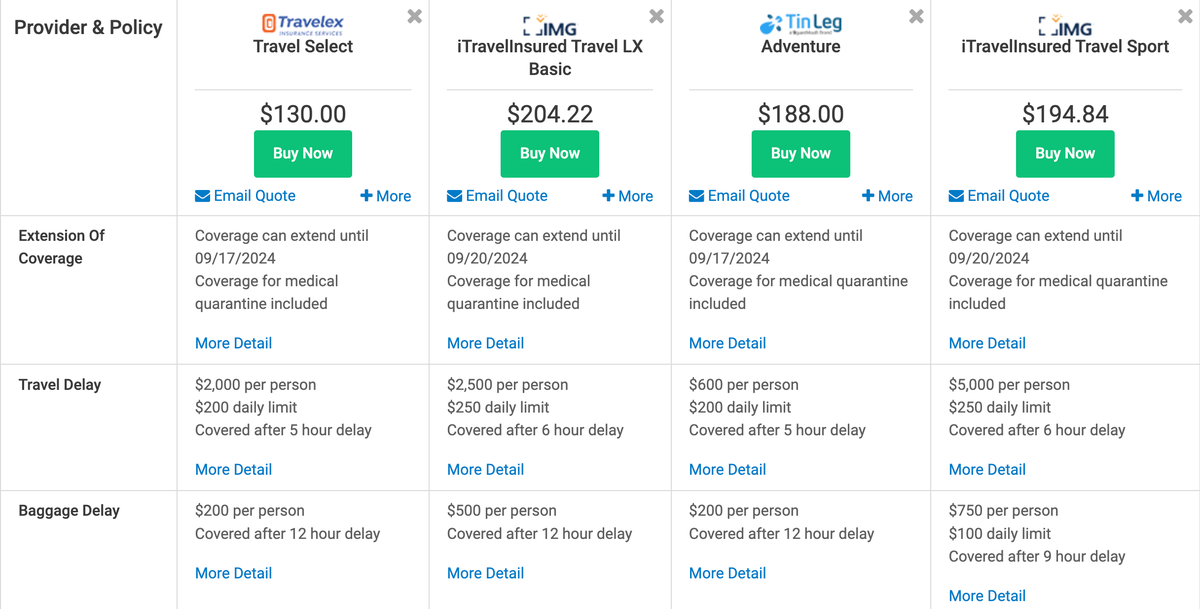

All of the policies allow for extensions if you’re quarantined or injured during the trip, with the IMG policies providing up to 10 days of extension. The other policies provide only 7 days of extension. The waiting period for travel delay coverage is similar in all policies, but the TinLeg Adventure policy has a much lower maximum payout for expenses you incur during delays: just $600, while the other policies are in the thousands. Also, the IMG policies have higher maximum payouts for baggage delays than Travelex and TinLeg. This could be important if your suitcase full of dive gear is delayed and you have to rent a full kit for several days.

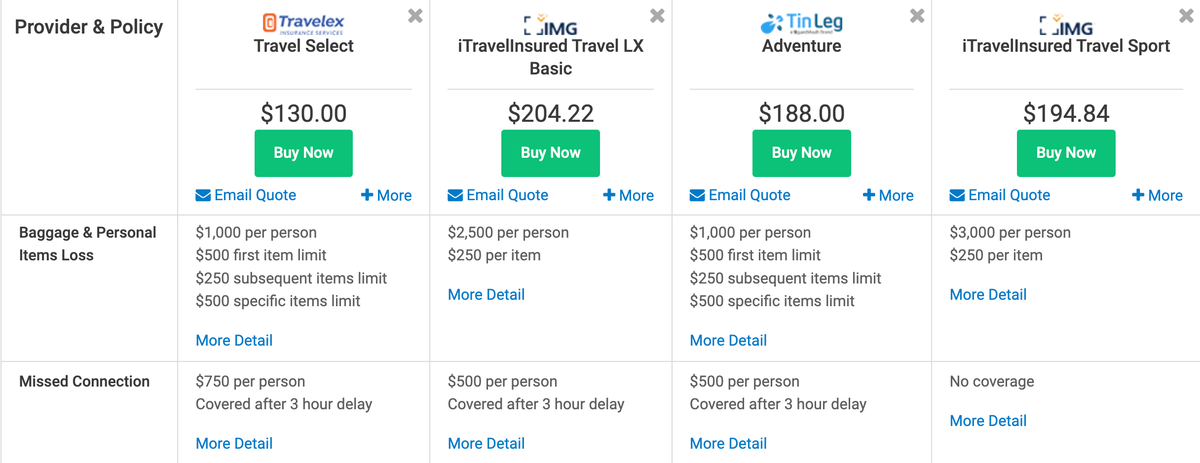

Speaking of gear, if items become lost, stolen, or damaged while you’re traveling, that’s not just a headache. It’s also expensive. These policies can help cover costs, but they all have flaws here. Travelex and TinLeg only cover up to $1,000 per person. All policies have per-item maximum costs of $250 or $500. That won’t cover the full cost of your waterproof housing with external lights for your camera or your BCD. Note that the IMG Travel Sport plan doesn’t cover missed connections that create extra costs during your trip, but the other plans cover this.

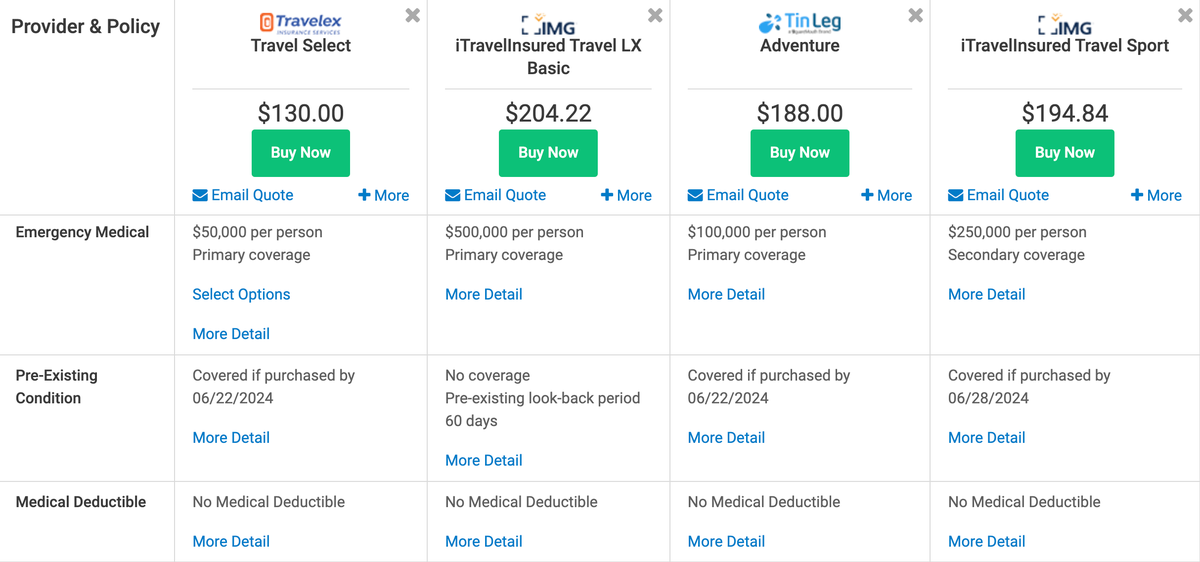

Now, let’s talk about the medical issues you could encounter during your trip. IMG’s Travel LX Basic doesn’t include coverage for preexisting conditions, but the other plans have allowances for these under certain conditions. None of the plans have a medical deductible, which is great. However, emergency medical maximum payouts range considerably across the plans.

IMG’s Travel Sport is the only plan where coverage is secondary, and its maximum payout is $250,000. The lowest coverage maximum comes on the Travelex plan, at $50,000. IMG’s Travel LX Basic has the highest coverage amount, at $500,000 per person.

Costs From DAN for Diving-Focused Coverage

Now, let’s turn our focus to diving-specific insurance. The industry leader in this area is Divers Alert Network, or DAN for short.

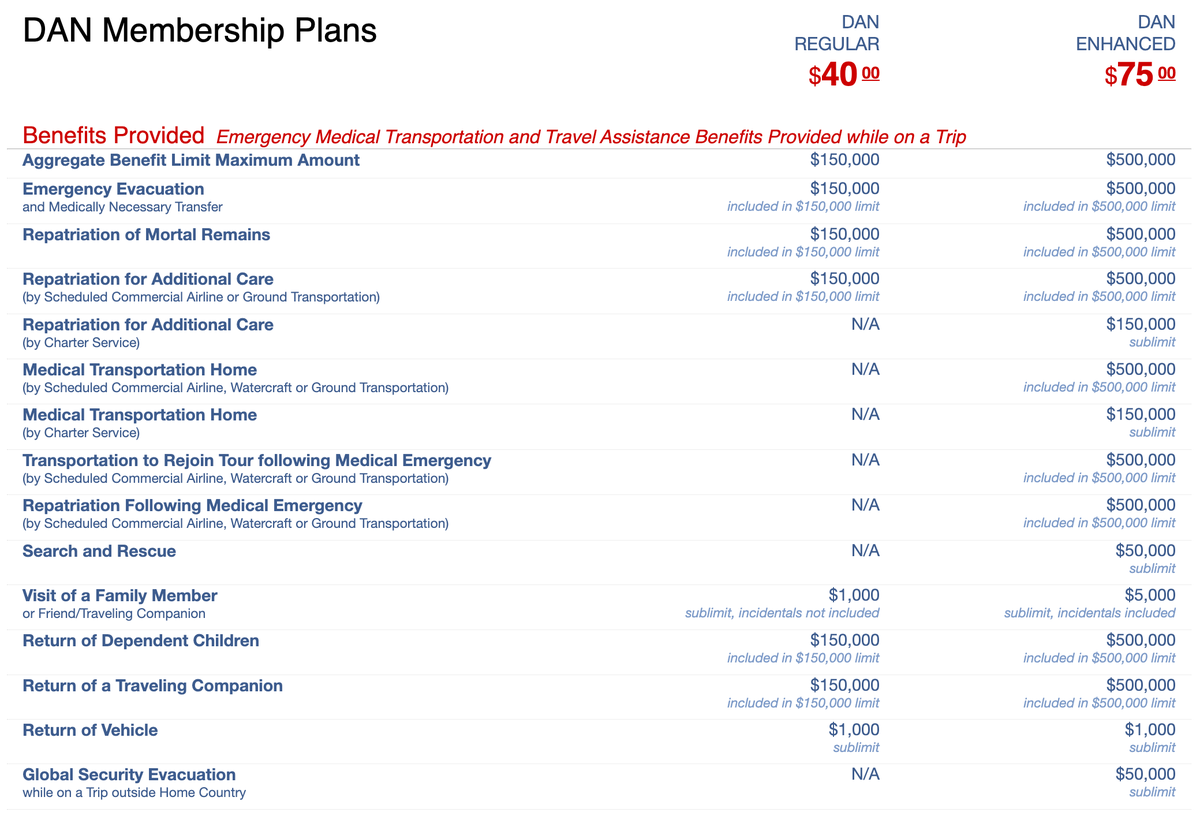

Before you can buy one of DAN’s dive accident insurance policies, you must have a membership. You can buy an individual or family plan, and each has an option for Regular or Enhanced membership.

Both membership types include coverage for emergency evacuation costs, repatriation of remains, family member visits if you’re in a hospital away from home, costs for returning your rental car on your behalf, and even costs for getting your children home after you’re in an accident. The maximum benefit payouts are typically 3 to 4 times higher with the Enhanced membership. The Enhanced membership also has additional benefits not offered on the Regular plan: medical transportation to get home, transportation to rejoin a tour after you had an emergency, search and rescue costs, and repatriation after an emergency.

The cost for an individual membership are $40 for Regular and $60 for Enhanced. Those costs increase to $75 and $100, respectively, for a family membership. To create a family membership, you must attest that all adults and children on the plan live at the same address.

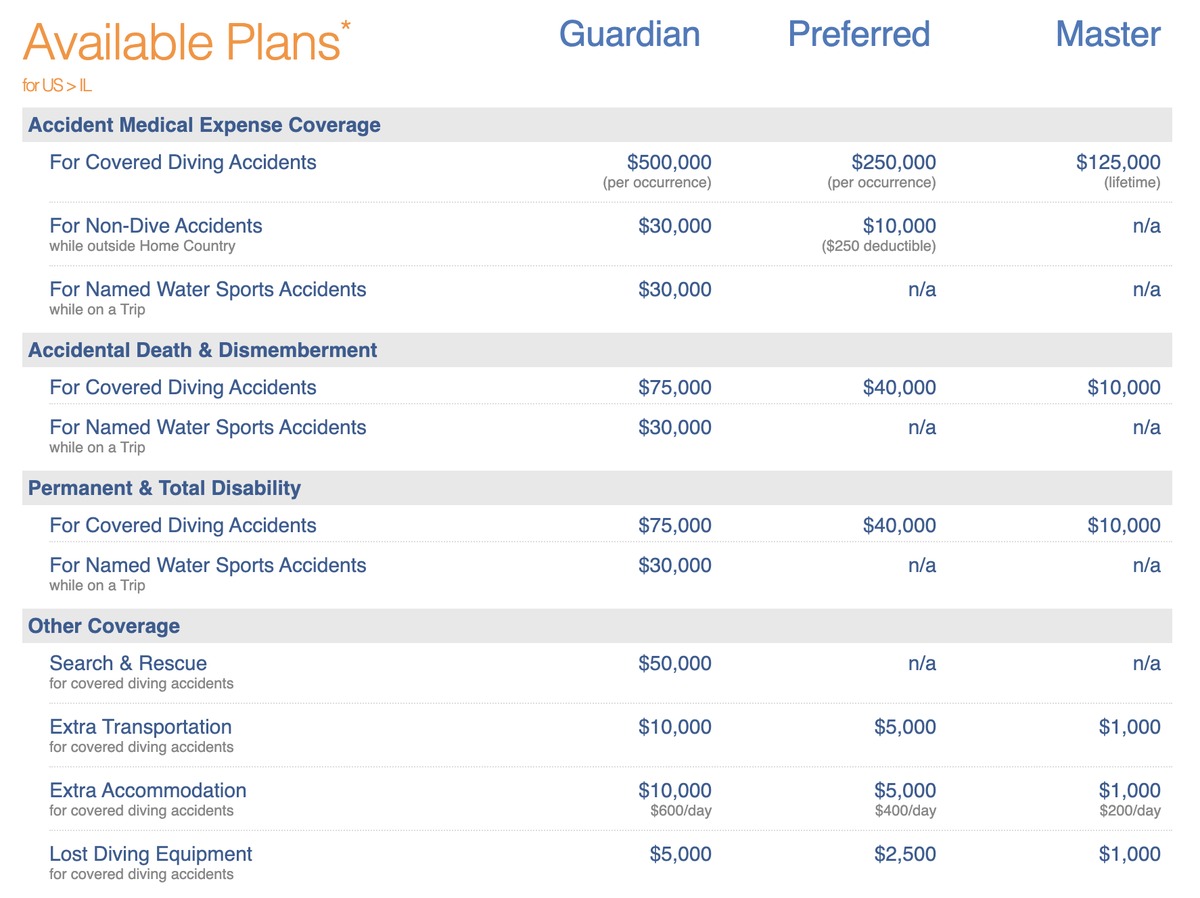

Once you have a DAN membership, you can sign up for its travel insurance with scuba diving accident and emergency coverage. Regardless of whether you have a Regular or Enhanced membership, you’ll find 3 plans: Guardian, Preferred, and Master. Master is the most basic plan, while Guardian is the most robust.

The key focus of these plans is covering you for accidents and emergencies likely to occur during water sports, largely focused on diving (though that’s not the only activity covered). With this focus, you won’t find things like flight delay insurance or delayed luggage insurance — items covered with more traditional travel insurance. Instead, the plans cover medical expenses, extra accommodation costs, lost diving equipment, and disability — so far as any of these are related to diving accidents.

The Preferred and Guardian plans also cover medical expenses not related to diving when you’re in another country, and the Guardian plan covers a much broader list of accidents and emergencies related to all water activities.

It’s also worth pointing out that only the Guardian plan provides additional coverage for search and rescue costs, should a rescue operation be mounted to find you and then a bill sent your way for the costs involved.

While it may seem confusing to find a list of coverage for a DAN membership and a separate list for DAN’s scuba diving travel insurance, you can best understand the differences like this: A DAN membership can cover the costs of getting you, your belongings, and your travel group home after a diving-related accident. DAN’s insurance plans, conversely, cover the medical costs related to your water accidents or emergencies.

What Scuba Diving Travel Insurance Covers (and Doesn’t Cover)

The more traditional travel insurance companies offer reimbursement for money lost or expenses you incur during delays, cancellations, and interruptions for your trip. They also can cover costs related to baggage delays, such as needing to rent gear for a day if your suitcase didn’t arrive at your destination. These plans also can cover damage to or loss of your luggage, and they provide varying amounts of emergency medical coverage should you become sick or injured during a trip. And so long as you compare plans with add-ons for scuba diving coverage, the medical coverage should apply to any accidents or injuries that happen in the water.

However, these plans don’t cover every risk related to diving, such as needing emergency transportation to a decompression chamber or replacing your equipment if you had to ditch it to help a troubled diver.

The plans from DAN focus largely on the latter and may be seen as a supplement to traditional travel insurance focusing on flight delays and cancellations. Divers Alert Network plans include the following:

- Emergency medical transportation by land, air, or sea to the nearest qualified hospital or hyperbaric chamber to provide the treatment you need

- Hospital charges

- Hyperbaric chamber treatment costs

- Costs related to permanent and total disability after a covered diving accident

- Extra transportation or accommodation costs if you need to stay at your destination for recuperation or can’t use your original ticket home after a covered accident

- Replacement of lost or damaged diving gear after a covered accident

- Includes divers over age 70 now after policy updates

How To Get Travel Insurance That Covers Scuba Diving

To find the right policy for you, comparison shopping is the best way to start. To compare plans, use a comparison website like Squaremouth. After filling out information about your intended trip, costs, and what you’re looking for, you can compare plans side by side to see their differences and costs. This lets you select the best option from what’s available.

Conversely, if your top priority is covering potential diving accidents, DAN has been the leader in this area for a while now. Run by divers, it may better (and more quickly) understand the issue than a customer service number for a general travel insurance company when there’s a diving accident involved. That said, DAN doesn’t cover every aspect of your trip, so it’s worth evaluating what parts of your trip you’re not protecting and what nonrefundable costs you’re not insuring.

There’s also a third option: getting both a travel insurance policy and a dive accident-focused policy. DAN’s diving accident coverage applies annually, and it may be worth purchasing a cheap travel insurance policy any time you head away from home to dive. Getting a weeklong policy to cover your flights, hotel costs, and other travel expenses can provide peace of mind when it’s time to travel, and a policy from DAN can provide peace of mind in the water.

Final Thoughts

Even after hundreds of dives without ever needing evacuation or emergency treatment, I still consider scuba diving travel insurance worth it. If something goes wrong underwater, the costs to get emergency care can skyrocket quickly. While you hope you never need to file a claim for a serious diving accident, you’ll be glad someone else is picking up the tab if you do.

Consider the list of options above to see which is the best fit for your diving plans. If you dive infrequently and always near top-notch facilities, that might make you pick a different plan than someone who frequents live-aboard vessels that take them far from a hyperbaric chamber while diving day in and day out.

)